Collapse is a frightening subject. The question of why collapse occurs is something I have pieced together over many years of study from a number of different sources, which I will attempt to explain in this post.

Collapse doesn’t happen instantaneously; it happens many years after an economy first begins outgrowing its resource base. In fact, the resource base likely declines at the same time from multiple causes, such as soil erosion, deforestation and oil depletion. Before collapse occurs, there seem to be warning signs, including:

- Too much wage disparity

- Riots and protests by people unhappy with low wages

- Prices of commodities that are too low for producers that need to recover their costs of production and governments that require tax revenue to fund programs for their citizens

- An overstretched financial system; conditions ripe for debt defaults

- Susceptibility to epidemics

Many people have the misimpression that our most important problem will be “running out” of oil. Because of this, they believe that oil prices will rise high if the system is reaching its limits. Since oil prices are not very high, they assume that the problem is far away. Once a person understands what the real issue is, it is (unfortunately) relatively easy to see that the current economy seems to be quite close to collapse.

In this post, I provide images from a recent presentation I gave, together with some comments. A PDF of the presentation can be downloaded here:

In some ways, a self-organizing system is analogous to a dome that might be built with a child’s toy building set (Slide 4). New layers of businesses and consumers are always being added, as are new regulations, more or less on top of the prior structure. At the same time, old consumers are dying off and products that are no longer needed are being discontinued. This happens without central direction from anyone. Entrepreneurs see the need for new products and try to satisfy them. Consumers decide on what to buy, based upon what their spendable income is and what their needs are.

Resources of many kinds are needed for an economy. Harnessing energy of many types is especially important. Early economies burned biomass and used the labor of animals. In recent years, we have added other types of energy, such as fossil fuels and electricity, to supplement our own human energy. Without supplemental energy of various kinds, we would be very limited in the kinds of goods and services that could be produced. Our farming would be limited to digging in the ground with a stick, for example.

The fact that there is almost an equivalence between employees and consumers is very important. If the wages of consumers are high, relative to the prices of the goods and services available, then consumers are able to buy many of those goods and services. As a result, citizens tend to be happy. But if there are too many low paid workers, or people without work at all, consumers are likely to be unhappy because they cannot afford the basic necessities of life.

The problem civilizations are facing is a two-sided problem: (1) Growing population and (2) Resources that often degrade or deplete. As a result, the amount of resources per person falls. If this were carried to the limit, all of us would starve.

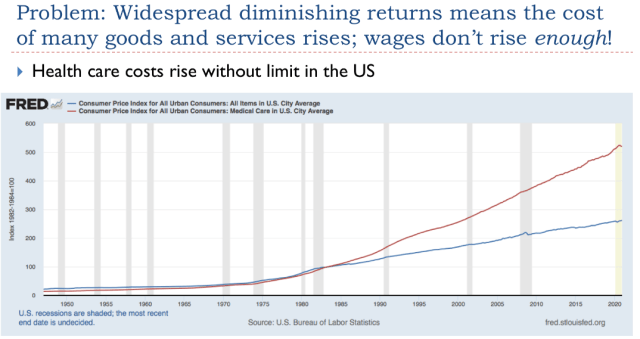

As resources deplete and population grows, local leaders can see that problems are on the horizon. At first, adding technology, such as a new dam to provide water to make farms more productive, helps. As more and more technology and other complexity is added, there is less and less “bang for the buck.” We can easily see this in the healthcare field. Early antibiotics had a very big payback; recent medical innovations that help a group of 500 or 1000 people with a particular rare disease can be expected to have a much smaller payback.

A second issue with added complexity is that it increasingly leads to a society of the very wealthy plus many very low paid workers. Joseph Tainter identified the combination of these two issues as leading to collapse in his book, The Collapse of Complex Societies.

Françios Roddier is an astrophysicist who writes primarily in French. His book Thermodynamique de l’évolution was published in 2012; it is now available in English as well.

The issue of starving people in Yemen is an issue today. In fact, hunger is an increasing problem in poor countries around the world. The world tourism industry is dead; the industry of making fancy clothing for people in rich countries is greatly reduced. People who formerly made a living in these industries in poor countries increasingly find it difficult to earn an adequate living with other available jobs. Rich countries tend to have better safety nets when there are widespread reductions in job-availability.

Businesses often make long lasting goods such as machines to be used in factories or automobiles to be used by consumers. Governments often make long-lasting goods such as paved roads and school buildings. When making these goods, they take some combination of commodities, built machinery, and human labor to make goods and services that people will use for many years into the future. The future value of these goods is hoped to be significantly greater than the value of the inputs used to create these goods and services.

There are at least three reasons that time-shifting devices are needed:

- Workers need to be paid as these goods are made.

- Businesses need to build factories in advance.

- Businesses, governments and individuals are all likely to find the future payments more manageable, even with interest added, than they are as a single payment upfront.

I don’t mention the issue in Slide 9, but once time-shifting devices are created, they become very easy to manipulate. For example, no one knows precisely what the future value of a particular investment will be. Governments, especially, are prone to make investments in unneeded infrastructure, simply to provide jobs for people. We also know that there are diminishing returns to added technology, but stocks of technology companies tend to be valued as if complexity will save the world. Third, interest rate manipulations (lower!) and the offering of debt to those who seem unlikely to be able ever to repay the debt can be used to make the economy of a country appear to be in better shape than it really is. Many of us remember the collapse of the US subprime housing debt bubble in 2008.

The purpose of a financial system is to allocate goods and services. High wages allocate a larger share of the output of an economy to a particular person than low wages. Appreciation in asset values (such as prices of shares of stock, or value of a home or piece of land) also act to increase the share of the goods and services produced by the economy to an individual. Payment of interest, dividends and rents are other ways of allocating goods and services that the economy makes. Governments can print money, but they cannot print goods and services!

As the economy gets more complex, the non-elite workers increasingly get left out of the distribution of goods and services. For one thing (not mentioned on Slide 10), as the economy becomes more complex, an increasing share of the goods and services produced by the economy need to go into making all of the intermediate goods that make that industrial economy work. Intermediate goods would include factories, semi-trucks, hydroelectric dams, oil pipelines and other goods and services that don’t directly benefit an individual consumer. They are needed to make the overall system work.

As the economy gets bigger and more complex, the non-elite workers increasingly find themselves left out. Besides losing an increasing part of the output of the intermediate goods and services mentioned in the prior paragraph, there are other pieces that take slices of the total output of goods and services:

- High paid workers take their quite-large slices of the total output. These individuals tend to be the ones who get the benefit of asset appreciation, as well.

- Pension programs and other programs to help the elderly and unemployed take a cut.

- Health insurance costs, in the US at least, tend to be very high, relative to wages, for lower-paid workers.

- The work of some employees can be replaced by low-paid overseas employees or by robots. If they are to keep their jobs, their wages need to be suitably low to compete.

With all of these issues, the workers at the bottom of the employment hierarchy increasingly get left out of the distribution of goods and services made by the economy.

We know some of the kinds of things that happen when economies are close to collapse from the writings of researchers such as Peter Turchin, lead author of Secular Cycles, and Joseph Tainter, mentioned earlier. One approach is for governments to try to work around the resource problem by starting wars with other economies whose resources they might gain. Probably a more likely outcome is that these low-resource-per-capita economies become vulnerable to attack by other economies because of their weakened condition. In any event, more conflict is likely as resource limits hit.

If the low incomes of non-elite workers persist, many bad outcomes can be expected. Local riots can be expected as citizens protest their low wages or pensions. Governments are likely to find that they cannot collect enough taxes. Governments will also find that they must cut back on programs, or (in today’s world) their currencies will sink relative to currencies of other countries. Intergovernmental organizations may fail for lack of funding, or governments may be overthrown by unhappy citizens.

Debt defaults can be expected. Governments have a long history of defaulting on their debts when conditions were bad according to Carmen Reinhart and Kenneth Rogoff in This Time Is Different: Eight Centuries of Financial Folly.

It becomes very easy for epidemics to take hold because of the poor eating habits and the close living quarters of non-elite workers.

With respect to inflation-adjusted commodity prices, it is logical that they would stay low because a large share of the population would be impoverished and thus not able to afford very many of these commodities. A person would expect gluts of commodities, as occurred during the Great Depression in the 1930s in the United States because many farmers and farm-hands had been displaced by modern farming equipment. We also find that the book of Revelation from the Bible seems to indicate that low prices and lack of demand were problems at the time of the collapse of ancient Babylon (Revelation 18:11-13).

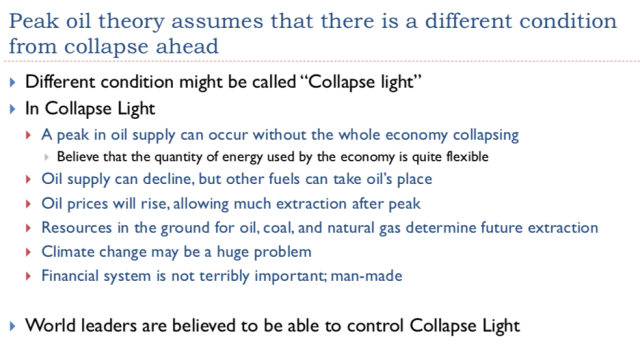

Much of what peak oil theory misunderstands is what our society as a whole misunderstands. Most people seem to believe that our economy will grow endlessly unless we somehow act to slow it down or stop it. They cannot imagine that the economy comes with built-in brakes, provided by the laws of physics.

Armed with a belief in endless growth, economists assume that the economy can expand year after year at close to the same rate. Modelers of all kinds, including climate modelers, miss the natural feedback loops that lead to the end of fossil fuel extraction without any attempt on our part to stop its extraction. A major part of the problem is that added complexity leads to too much wage and wealth disparity. Eventually, the low wages of many of the workers filter through to oil and other energy prices, making prices too low for producers.

Collapse isn’t instantaneous, as we will see on Slide 26. As resources per capita fall too low, there are several ways to keep problems hidden. More debt at lower interest rates can be added. New financial techniques can be developed to hide problems. Increased globalization can be used. Corners can be cut on electricity transmission, installation and maintenance, and in the building of new electricity generating structures. It is only when the economy hits a bump in the road (such as a climate-related event) that there suddenly is a major problem: Electricity production fails, or not enough food is produced. In fact, California, Florida, and China have all encountered the need for rolling blackouts with respect to electricity in the past year; China is now encountering difficulty with inadequate food supply, as well.

Economists have played a major role in hiding problems with energy with their models that seem to show that prices can be expected to rise if there is a shortage of oil or other energy. Their models miss the point that adequate supplemental energy is just as important for demand as it is for supply of finished goods and services. The reason energy is important for demand is because demand depends on the wages of workers, and the wages of workers in turn depend on the productivity of those workers. The use of energy supplies to allow workers to operate tools of many kinds (such as computers, trucks, electric lights, ovens, and agricultural equipment) greatly influences the productivity of those workers.

A person who believes energy prices can rise endlessly is likely to believe that recycling can increase without limit because of ever-rising prices. Such a person is also likely to believe that the substitution of intermittent renewables for fossil fuels will work because high prices for scarce electricity will enable an approach that is inherently high-cost, if any continuity of supply is required.

Thus, the confusion isn’t so much that of peak oilers. Instead, the confusion is that of economists and scientists building models based on past history. These models miss the turning points that occur as limits approach. They assume that future patterns will replicate past patterns, but this is not what happens in a finite world. If we lived in a world without limits, their models would be correct. This confusion is very much built into today’s thinking.

In fact, we are living in an economic system/ecosystem that has brakes to it. These brakes are being applied now, even though 99%+ of the population isn’t aware of the problem. The system will protect itself, quite possibly using the approach of evicting most humans.

The opinions expressed in Slide 13 reflect some of the views I have heard expressed speaking with peak oilers and with people looking into issues from a biophysical economics perspective. Obviously, views differ from person to person.

Many people believe that resources in the ground provide a good estimate of the quantity of fossil fuels that can be extracted in the future. Peak oilers tend to believe that the available resources will need to have sufficiently high “Energy Returned on Energy Invested” (EROEI) ratios to make extraction feasible. Politicians and climate modelers tend to believe that prices can rise endlessly, so low EROEI is no obstacle. They seem to believe that anything that we have the technical skill to extract, even coal under the North Sea, can be extracted.

If a person believes the high estimates of fossil fuel resources that seem to be available and misses the point that the economy has built-in brakes, climate change becomes the issue of major concern.

My view is that most of the resources that seem to be available will be left in the ground because of low prices and problems associated with collapse, such as failing governments and broken supply lines. In any event, we do not really have the ability to fix the climate; the laws of physics will provide their own adjustment. We will simply need to live with whatever climate is provided. Humans lived through ice-ages in the past. Presumably, whatever remanent of humans remains after what seems to be an upcoming bottleneck will be able to live in suitable areas of the world in the future.

On Slide 14, note that today’s industrial economy must necessarily come to an end, just as the lives of hurricanes and of people come to an end.

Also note that with diminishing returns, the cost of producing many of the things listed on Slide 14 is rising. For example, with rising population, dry areas of the world eventually need to use desalination to get enough fresh water for their growing populations. Desalination is expensive. Even if the necessary workaround is simply deeper wells, this still adds costs.

With diminishing returns affecting many parts of the economy simultaneously, it becomes increasingly difficult for efforts in the direction of efficiency to lead to costs that are truly lower on an inflation-adjusted basis. Advanced education and health care in particular tend to have an ever-rising inflation-adjusted costs of production. Some minerals do as well, as the quality of ores deplete.

An important issue to note is that wages need to cover all the rising costs, even the rising cost of health care. The paychecks of many people, especially those without advanced education, fall too low to meet all of their needs.

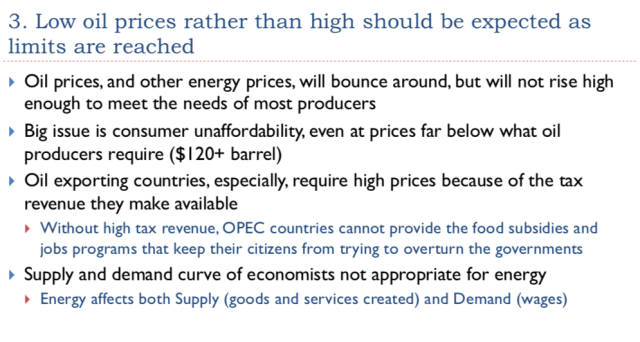

Slides 16 and 17 describe some of the reasons why oil prices don’t necessarily rise with scarcity.

I was one of the co-authors of the Ke Wang paper mentioned in Slide 18. We developed three different forecasts of how much oil would be extracted in China, depending on how high oil prices would be able to rise. The Red Line is the “Stays Low” Scenario, with prices close to $50 per barrel. The Yellow Line is the “Ever Rising Price” Scenario. The Best Estimate reflects the expectation that prices would be in roughly the $100 to $120 barrel range, from 2015 onward.

In fact, oil prices have stayed fairly low, and China’s oil production has declined, as our paper predicted.

Note that the chart on Slide 21 shows wage disparity only in the US. On this basis, the share of wages going to the top 1% and top 0.1% are back at the levels that they were in the 1920s. Now, our economy is much more global. If we consider all of the low income people in the world, the worldwide wage disparity is much greater.

There are two things to note on Slide 22. The first is that producers, in inflation-adjusted terms, seem to need very high prices, approximately $120 per barrel or more. This is based on a presentation made by Steve Kopits, which I wrote up here: Beginning of the End? Oil Companies Cut Back on Spending.

The other thing to note is that oil prices tend to bounce around a great deal. Prices seem to depend on the amount of debt and on interest rates, as well as the wages of workers. The peak in oil prices in mid-2008 came precisely at the time the debt bubble broke with respect to mortgage and credit card debt in the US. I wrote about this in an article in the journal Energy called, Oil Supply Limits and the Continuing Financial Crisis.

The US instituted Quantitative Easing (QE) at the end of 2008. QE acted to lower interest rates. With the help of QE, the price of oil gradually rose again. When the US discontinued QE in late 2014, oil prices fell. Recently, there has been a great deal of QE done, as well as direct spending by governments, oil prices are still far below the $120 per barrel level. Middle Eastern oil producers especially need high oil prices, in order to collect the high tax revenue that they depend upon to provide programs for their citizens.

Coal prices (Slide 23) tend to follow somewhat the same pattern as oil prices (Slide 22). There is very much the same balancing act with coal prices as well: Coal prices need to be high enough for producers, but not too high for customers to buy products made with coal, such as electricity and steel.

China tries to keep its coal prices relatively high in order to encourage production within the country. China has been limiting imports to try to keep prices high. The relatively high coal prices of China make it an attractive destination for coal exporters. There are now a large number of boats waiting outside China hoping to sell coal to China at an attractive price.

The blue line on Figure 24 represents total energy consumption up through 2020. The red dotted line is a rough guesstimate of how energy consumption might fall. This decline could happen if people wanting energy consumption coming only from renewables were able to succeed by 2050 (except I am doubtful that these renewable energy types would really be of much use by themselves).

Alternatively, this might also be the decline that our self-organizing economy takes us on. We are already seeing a decrease in energy consumption related to the current pandemic. I think governmental reactions to the pandemic were prompted, in part, by the very stretched condition of our oil and other energy supplies. Countries were experiencing riots over low wages. They also could not afford to import as much oil as they were importing. Shutdowns in response to COVID-19 cases seemed like a sensible thing to do. They helped restore order and saved on energy imports. Strangely enough, the pandemic may be a part of the collapse that our self-organizing economy is arranging for us.

Slide 25 takes the blue line from Slide 24 and looks at what happened in more detail. On Slide 25, we are looking at the average annual increase in energy consumption, for a given 10 year period. This is split between the rate of population growth (blue), and the energy consumption growth that went into other things, which I equate to change in “standard of living” (red). The big red humps represent very good times, economically. The post-World War II bump is especially high. The valleys are times of disturbing changes, including wars and the collapse of the Soviet Union.

Of course, all of these situations occurred during periods when energy consumption was generally rising. If these unfortunate things happened when oil consumption was rising, what might possibly happen when energy consumption is falling?

We now seem to be hitting the Crisis Stage. In the past, collapse (which takes place in the Crisis Stage) has not been instantaneous; it has taken place over quite a number of years, typically 20 or more. The world economy is quite different now, with its international trade system and heavy use of debt. It would seem likely that a collapse could happen more quickly. A common characteristic of collapses, such as avalanches, is that they often seem to start off fairly slowly. Then, suddenly, a large piece breaks away, and there is a big collapse. Something analogous to this could possibly happen with the economy, too.

One of the major issues with adding intermittent renewables to the electric grid is a pricing problem. Once wind and solar are given subsidies (even the subsidy of “going first”), all of the other types of electricity production seem to need subsidies, as well. It is the pricing systems that are terribly detrimental, although this is not generally noticed. In fact, researchers who are looking only at energy may not even care if the pricing is wrong. Ultimately, the low pricing for electricity can be expected to bring the electric grid down, just as inadequate prices for fossil fuels can be expected to lead to the closure of many fossil fuel producers. Both Texas and California are having difficulty because they have not been collecting enough funds from customers to build resilient systems.

The focus of EROEI research is often with respect to whether the EROEI of a particular type of energy production is “high enough,” relative to some goal, such as 3:1 or 10:1. I believe that there needs to be more focus on the total quantity of net energy produced. If there is a EROEI goal for highly complex energy types, it needs to be much higher than for less complex energy types.

Today, it is common to see the EROEIs of a number of different types of energy displayed side-by-side as if they were comparable. This type of comparison is also made with other energy metrics, such as “Levelized Cost of Electricity” and “Energy Payback Period.” I think this approach makes highly complex types of energy production, such as intermittent wind and solar, look better than they really are. Even intermittent hydroelectric power generation, such as is encountered in places with rainy seasons and dry seasons and in places that are subject to frequent droughts, is not really comparable to electricity supply that can be provided year-around by fossil fuel providers, if adequate storage is available.

Earlier in this post, I documented a number of reasons why we should expect low rather than high energy prices in the future. I am reiterating the point here because it is a point energy researchers need especially to be aware of. Production is likely to come to an end because it is unprofitable.

One characteristic of human-made complexity is that it has very little redundancy. If something goes wrong in one part of one system, it is likely to ripple through that system, as well as other systems to which the first system is connected. An outage of oil is likely to indirectly affect electricity because oil is needed to fix problems with electricity transmission lines. An electricity outage may cause disruption in oil drilling and refining, and even in filling up automobiles at service stations. An international trade disruption can break supply lines and leave shipping containers at the wrong end of the globe.

We know that collapse tends to lead to less complex systems. We should expect fewer jobs requiring advanced education. We should expect to start losing battles against infectious diseases. We should expect a reduction in international trade; in the future, it may primarily take place among a few trusted partners. Some intergovernmental organizations are likely to disappear. Peak oil cannot happen by itself; it can only happen with disruptions and shrinkage in many other parts of the economy, as well.

The climate is indeed changing. Unfortunately, we humans have little ability to change what is happening, especially at this late date. Arguably, some changes could have been made much earlier, for example in the 1970s when the modeling included in the 1972 book The Limits to Growth by Donnela Meadows and others showed that the world economy was likely to hit limits before 2050.

It is clear to many people that the world economy is now struggling. There is too much debt; young people are having trouble finding jobs that pay well enough; people in poor countries are increasingly more food insecure. Leaders everywhere would like solutions. The “easy” solution to offer is that intermittent wind and solar will solve all our problems, including climate change. The closer a person looks at the situation, this solution is simply nonsense. Wind and solar work passably well at small concentrations within electric systems, if it is possible to work around their pricing problems. But they don’t scale up well. Energy researchers especially should be aware of these difficulties.

The book Rare Earth: Why Complex Life Is Uncommon in the Universe by Peter Ward and Donald Brownlee points out that there have been an amazing number of what seem to be coincidences that have allowed life on earth to flourish on earth for four billion years. Perhaps these coincidences will continue. Perhaps there is an underlying plan that we are not aware of.

Gail E. Tverberg graduated from St. Olaf College in Northfield, Minnesota in 1968 with a B.S. in Mathematics. She received a M.S. in Mathematics from the University of Illinois, Chicago in 1970. Ms. Tverberg is a Fellow of the Casualty Actuarial Society and a Member of the American Academy of Actuaries. Ms. Tverberg began writing articles on finite world issues in early 2006. Since March 1, 2007, Ms. Tverberg has been working for Tverberg Actuarial Services on finite world issues. Her blog is http://ourfiniteworld.com

GET COUNTERCURRENTS DAILY NEWSLETTER STRAIGHT TO YOUR INBOX

Related posts:

Related posts:

Views: 0

RSS Feed

RSS Feed

February 26th, 2021

February 26th, 2021  Awake Goy

Awake Goy

Posted in

Posted in  Tags:

Tags: