On September 28, President Donald Trump signed a presidential permit to ship Alberta’s tar sands oil via a proposed 1,600-mile private rail line across the U.S.-Canada border into Alaska.

The permit, given to the company Alaska-Alberta Railway Development Corporation, is the same type of border-crossing permit that Trump approved in 2017 for the controversial Keystone XL pipeline. Both projects aim to ship Alberta’s crude — some of the most carbon-intensive in the world — across international borders.

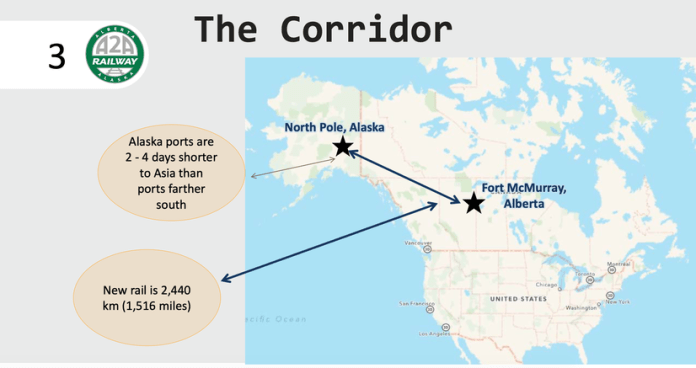

Referred to as A2A Rail, the project is specifically touted by its proponents as a way to expedite exports to Asian markets. Wearing other hats, those same proponents have for years emphasized the potential economic benefits of melting Arctic sea ice, which would allow a shorter journey for shipping commodities like oil from Alaska to overseas markets in the eastern hemisphere.

Chief among them is A2A Rail’s vice chair, Mead Treadwell, former Alaska Republican Lt. Governor and former chair of the U.S. Arctic Research Commission. He has articulated this view about the melting Arctic despite also having a track record of climate change denial. EnergyWire reported in 2010 that, in a statement given to a conservative group, he disagrees with “the argument that man made CO2 emissions are causing significant global warming.”

Treadwell was also formerly the president of Pt Capital, an Anchorage, Alaska-based private equity firm with aims to profit from a melting Arctic, as Bloomberg reported in 2014. A2A formerly invested in Pt Capital, which is the first-ever U.S. firm specifically dedicated to investing in the opportunities of this thawing polar region. Treadwell recently rejoined the Board of Directors of Pt Capital. He declined to comment for this story.

A2A’s recent presidential permit received praise from Alaska Governor Mike Dunleavy (R), Alberta’s premier, and Alaska’s congressional delegation. In his hallmark style, Trump first announced he would issue the permit via a September 25 tweet. Members of the congressional delegation did not respond to a request for comment for this story about their views on climate change.

Bill McKibben, the co-founder of 350.org, the global climate advocacy group that launched the national fight against Keystone XL in 2011, lamented the permit.

“The irony of seeing the melting Arctic as a route to get more planet-heating carbon out of the ground is almost too deep and sad for words,” he said.

Political influence

In recent years, A2A increasingly has become involved in efforts to influence politics in Washington, D.C.

On January 1, A2A registered to lobby via the firm Jack Ferguson Associates, owned by Jack Ferguson. Ferguson formerly served as chief of staff for the late U.S. Sen. Ted Stevens (R-AK) and as an aide to U.S. Rep. Don Young (R-AK), the longest-serving member of Congress. In his tweet announcing the permit, Trump specifically credited Young with bringing the oil-by-rail project to his attention. Young, for his part, tweeted that he worked with Mark Meadows, Trump’s Chief of Staff and his former congressional colleague, to nail down the permit.

A2A is also a major donor to the Polar Institute, a project of the Woodrow Wilson International Center for Scholars, commonly referred to as the Wilson Center. A Washington-based think tank established in 1968, the Wilson Center receives about 30 percent of its funding from congressional appropriations and is part of the Smithsonian Institution. A2A CEO Sean McCoshen is also listed as a major donor to the Wilson Center, while Treadwell sits as one of the co-chairs of the Polar Institute, a non-paid position.

Formed in 2017, the Polar Institute is an Artic-focused think tank which “addresses the practical questions and policy challenges facing the United States, Alaska, and citizens of the North” and focuses on shipping, icebreaker technology, and economic development in the region. Mike Sfraga, director of the Polar Institute, said the group does “not advocate or advance agendas of those who support our work.”

However, in a May 2019 congressional testimony, Treadwell advocated for creating an Arctic Seaway Development Corporation, which would aim to establish a toll system for shippers in the Alaskan Arctic modeled after the St. Lawrence Seaway, a canal and tollway system connecting all of the North American Great Lakes to the St. Lawrence River and eventually the Atlantic Ocean in Canada. Treadwell said such a funding mechanism would “bring nations together to offer a reliable, voluntary, tariff-based service that will attract and justify infrastructure investment” in the Arctic.

Just a month earlier, U.S. Sen. Lisa Murkowski (R-AK) and Young introduced legislation to create that Arctic seaway development corporation via the Shipping and Environmental Arctic Leadership Act (SEAL Act).

Treadwell testified to Congress that the SEAL Act was written in coordination with the Wilson Center, which his company helps fund.

In response to questions about funding, Sfraga said the Polar Institute does “not advocate or lobby the U.S. government on specific projects.” In its own explanation on its website, the Wilson Center states that it uses the “combination of federal and private funds … to inform actionable ideas for Congress, the Administration, and the broader policy community.”

Treadwell is not the only A2A employee with links to Murkowski via his advocoacy for the SEAL Act. Sean Solie, a former staffer for Murkowski on the Senate Committee on Energy and Natural Resources, now works as the business coordinator for A2A. And Frank Murkowski, the father of Sen. Murkowski and former U.S. Senator and Governor of Alaska, also was named a consultant in 2017 for previous Governor Bill Walker in his efforts to explore the possibility of an Alberta to Alaska rail line.

Treadwell’s Polar Institute co-chair is Alice Rogoff, who was listed as an advisor to Pt Capital on a 2016 version of its website. Hugh Short, the CEO of Pt Capital, said the firm does not “discuss internal advisor agreements as a policy” when asked if Rogoff still works as an advisor for the firm.

Rogoff hosted President Barack Obama for dinner during a 2015 visit to Alaska during which the president bore witness to the melting Arctic sea ice. Obama denied a presidential permit to Keystone XL just weeks after his Arctic visit.

From 2014 through 2017, Rogoff owned the Alaska Dispatch News, the state’s largest newspaper. She now owns the publication Arctic Today, an independent digital news site dedicated to covering the Arctic region. Treadwell sits on the Board of Directors of that publication.

Like Treadwell, Rogoff has advocated for business opportunities associated with a melting Arctic. In a 2013 talk to the Juneau World Affairs Council, she compared it to a future Panama Canal, according to Juneau-based KTOO Public Media.

Rogoff, who is the ex-wife of David Rubenstein — the chairman of the private equity giant Carlyle Group and a member of the Smithsonian Institution’s Board of Regents — declined to comment on the record for this story. Rubenstein spoke at the 2012 “Arctic Imperative” conference in Alaska that his ex-wife convened, introducing him as a “close relative.” During that speech, he called the Arctic the greatest “emerging market” in the world.

Rubeinstein’s colleague Robert Dove, the former Managing Director of Carlyle Infrastructure Partners, now works as head of finance and strategy for A2A.

According to her LinkedIn profile, Rogoff is also the chair and co-founder of C Change Arctic, Ltd., a capital investment firm incorporated in April 2020 which operates in a similar space to Pt Capital. The investment firm aims to “develop the region’s full economic potential and generate attractive investment returns” in the Arctic region, according to its website.

Bad investment?

Despite these high-level political ties, A2A Rail still has a steep hill to climb.

One part of that challenge is the price tag. The international cargo rail line will cost $17 billion to construct, according to the company. Hollis French, a former Democratic representative in the Alaska Legislature and member of the Alaska Oil & Gas Conservation Commission, said that cost will almost certainly mean the project will require a heavy dose of state and federal dollars.

“I personally wouldn’t invest in this project,” he said, pointing to the sinking price of oil globally and the high capital cost of extracting the tar sands and getting them to market. “And I doubt that any rational government would. So where the money will come from for this is anybody’s guess.”

For his part, A2A CEO McCoshen told Bloomberg in September that the project is “extremely viable” and “a win-win for all concerned.”

A2A’s advancement will also necessitate the consent of a number of tribal governments, whose lands would be crossed by the new rail line. Russ Diabo, a long-time Indigenous policy analyst and activist who lives in the Kahnawake Mohawk Territory, a First Nations reserve in Quebec, said he sees many parallels between A2A and the fight against Keystone XL led by Indigenous Peoples in both western Canada and Alaska, both for these projects’ potential impacts on people and on the environment.

Mass freight rail “involves land use. So putting a new train track and hauling stuff there is definitely going to affect wildlife,” said Diabo, who has consulted with tribal governments currently in communication with A2A. “They’ll move away from that. That’s what happens.”

Diabo worries that these effects will ultimately have a human impact, too, on the Indigenous communities.

“They’re using that area for hunting and fishing,” Diabo continued. “So I’m sure they’re going to be Indigenous communities that are going to be looking at that up there.”

For its part, A2A says, “Indigenous Peoples are an essential partner in making this project a success.”

Beyond that, A2A would also require approval of state agencies in Alaska and other U.S. federal agencies. That includes permits from the U.S. Bureau of Land Management, due to the rail line’s intersection with public lands.

The project still requires Canadian approval too. Prime Minister Justin Trudeau has already expressed skepticism about the project, saying he is not sure “whether there is a potential for a project” like this and wants to precaution A2A against going “too far down the round” and spending “too much money in it, in something that is unlikely to pass.”

Related posts:

Views: 0

RSS Feed

RSS Feed

November 1st, 2020

November 1st, 2020  Awake Goy

Awake Goy

Posted in

Posted in  Tags:

Tags: