There Is One Way Out of Debt-Serfdom: Fanatic Frugality

By Charles Hugh Smith

washingtonsblog.com

If we accept that our financial system is nothing but a wealth-transfer mechanism from the productive elements of our economy to parasitic, neofeudal rentier-cartels and self-serving state fiefdoms, that raises a question: what do we do about it?

The typical answer seems to be: deny it, ignore it, get distracted by carefully choreographed culture wars or shrug fatalistically and put one’s shoulder to the debt-serf grindstone.

There is another response, one that very few pursue: fanatic frugality in service of financial-political independence. Debt-serfs and dependents of the state have no effective political power, as noted yesterday in It Isn’t What You Earn and Owe, It’s What You Own That Generates Income.

There are only three ways to accumulate productive capital/assets: marry someone with money, inherit money or accumulate capital/savings and invest it in productive assets. (We’ll leave out lobbying the Federal government for a fat contract or tax break, selling derivatives designed to default and the rest of the criminal financial skims and scams used so effectively by the New Nobility financial elites.)

The only way to accumulate capital to invest is to spend considerably less than you earn. For a variety of reasons, humans seem predisposed to spend more as their income rises. Thus the person making $30,000 a year imagines that if only they could earn $100,000 a year, they could save half of their net income. Yet when that happy day arrives, they generally find their expenses have risen in tandem with their income, and the anticipated ease of saving large chunks of money never materializes.

What qualifies as extreme frugality? Saving a third of one’s net income is a good start, though putting aside half of one’s net income is even better.

The lower one’s income, the more creative one has to be to save a significant percentage of one’s net income. On the plus side, the income tax burden for lower-income workers is low, so relatively little of gross income is lost to taxes.

The second half of the job is investing the accumulated capital in productive assets and/or enterprises. The root of capitalism is capital, and that includes not just financial capital (cash) but social capital (the value of one’s networks and associations) and human capital (one’s skills and experience and ability to master new knowledge and skills).

I cover these intangible forms of capital in my book Get a Job, Build a Real Career and Defy a Bewildering Economy.

Cash invested in tools and new skills and collaborative networks can leverage a relatively modest sum of cash capital into a significant income stream, something that cannot be said of financial investments in a zero-interest rate world.

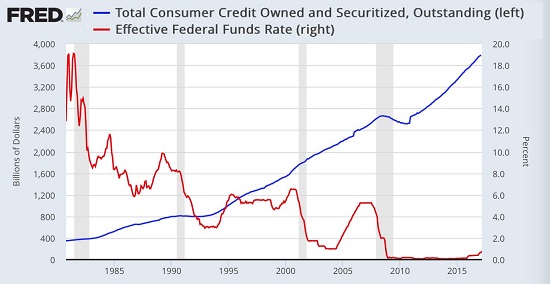

Notice anything about this chart of the U.S. savings rate? How about a multi-decade decline? Yes, expenses have risen, taxes have gone up, housing is in another bubble–all these are absolutely true. That makes savings and capital even more difficult to acquire and more valuable due to its scarcity. That means we have to approach capital accumulation with even more ingenuity and creativity than was needed in the past.

Meanwhile, we’ve substituted debt for income. This is the core dynamic of debt-serfdom.

As Aristotle observed, “We are what we do every day.” That is the core of fanatic frugality and the capital-accumulation mindset.

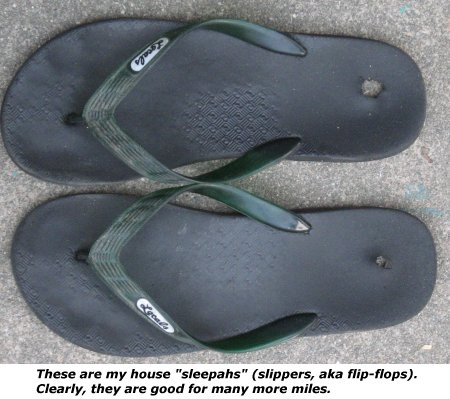

For your amusement: a few photos of everyday fanatic frugality (and dumpster-diving).

The only leverage available to all is extreme frugality in service of accumulating savings that can be productively invested in building human, social and financial capital.

Debt is serfdom, capital in all its forms is freedom. Waste nothing, build some form of capital every day, seek opportunity rather than distraction.

Debt = Serfdom (April 2, 2013)

How Frugal Are You? (August 7, 2010)

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

View the original article at Washingtons Blog

Source Article from http://feedproxy.google.com/~r/DarkPolitricks/~3/s84OyxkXKxg/

Related posts:

Views: 0

RSS Feed

RSS Feed

May 5th, 2017

May 5th, 2017  Awake Goy

Awake Goy  Posted in

Posted in  Tags:

Tags: