The electric revolution is the biggest change the auto industry has seen since Ford invented the assembly line in 1913.

But an impending supply shortage has put one critical resource in the global spotlight.

With the meteoric rise of Tesla, nearly every major automaker has shifted its sights towards producing the next great electric vehicle.

Ford made headlines this year with its announcement of the all-electric F-150 Lightning, which now has upwards of 200,000 pre-orders.

That electric enthusiasm has spread to nearly every other major automaker – including GM, Fiat Chrysler, Mitsubishi, Honda, Volvo, and BMW to name just a few.

This massive shift has driven demand for one crucial element sky-high.

That’s why Reuters recently reported, “Lithium producers grow bullish as the EV revolution turbocharges demand.”

The Wall Street Journal proclaimed, “Lithium booms in the battle for electric-vehicle batteries.”

But Barron’s warned, “The EV revolution needs more lithium.”

That’s just one of the reasons top-performing lithium companies have been on such a tear this year, with several stocks more than doubling since the start of the year.

Neo Lithium Corp. has taken off for 198% gains during that time.

American Lithium Corp. jumped for 326% gains.

And Vision Lithium is up an exceptional 577% for the year.

But the biggest winner in the lithium bull market could be one who doesn’t just make the next major mining discovery, but fundamentally transforms how lithium is mined around the world.

That’s why we have been following updates from Medaro Mining Corp. (CSE:MEDA; OTC:MEDAF) so closely.

Medaro is sitting on two promising projects in one of Canada’s top lithium-producing regions.

But it’s their new, proprietary technology that we believe could potentially play a role in changing the economics of lithium mining for exploration companies all across the globe.

Here are 3 reasons we plan to pay close attention to Medaro Mining in the months ahead:

If Developed and Commercialized, This New Technology Could Change Lithium Mining Forever

Medaro Mining (CSE:MEDA; OTC:MEDAF) and their joint-venture partner hold the intellectual property rights for the development of a unique, new Hard Rock Lithium Technology (HLT).

This novel approach to extracting lithium could help create a paradigm shift in the industry if proven successful in their upcoming drill projects.

But to fully grasp the gravity of the situation, it’s important to first understand a little about how lithium is processed today.

The precious mineral is primarily mined in one of two surfaces: brine or hard rock.

But the vast majority of lithium produced today comes from brine because it’s so much cheaper to process.

Hard rock mining is far more costly because miners need to separate the rock by crushing, grinding, separating, and performing flotation processes on the ore.

Not only can this be a long and intensive process, but there are also more costs tacked on top of that because it’s usually done by shipping the ore to a processing plant off-site for extraction.

In other words, there’s a large supply of lithium hidden inside hard rock surfaces around the world, and as it stands, it’s just too expensive for lithium miners to process it.

But Medaro’s unique new technology could help level the playing field by cutting hard rock processing costs by up to half while recovering nearly 100% of that lithium.

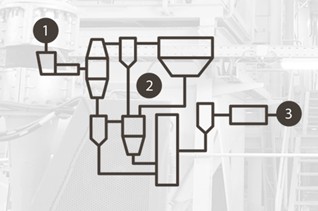

Here’s how it works.

The technology uses a natural solvent that’s recycled and reused in the system, lowering costs on replacing new solvents.

Next, it extracts lithium and other valuable byproducts like aluminum oxide and silica, which can also be sold to further offset production costs.

Finally, it converts the lithium to high-quality lithium carbonate, lithium hydroxide, or lithium metal.

The company reports this process is unlike anything on the markets today.

Not only is it cheaper and more effective, but it’s also environmentally friendly in a world where trillions of dollars are pouring into ESG funds.

Medaro Mining (CSE:MEDA; OTC:MEDAF) could begin testing the technology by mid to late 2022 through the construction of a pilot plant, with the coming months being pivotal in that process.

From there, they could possibly license that technology out to exploration companies across the globe, delivering new long-term revenue opportunities.

Successful implementation of such a technology could unlock a huge portion of the world’s lithium supply that’s been left unprocessed until now.

And that could be exactly what we need to keep the major companies like Tesla, Ford, and GM plowing ahead in the EV boom.

Exciting New Project in Canada’s Lithium Heartland

Medaro’s story goes beyond just their potentially transformational technology though.

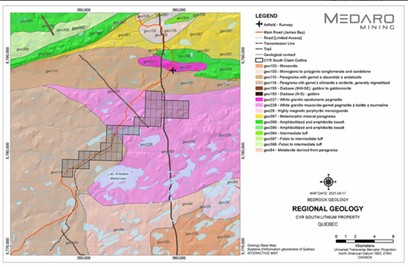

The team just finished Phase 1 of exploration in their new Cyr South lithium project in the prolific James Bay mining region of Quebec.

The Cyr South project is made up of 52 claims across 2,700 hectares in the heart of Canada’s lithium pegmatite region.

And the keen observer would see it’s located just 3 km south of the James Bay lithium project being explored by Galaxy Resources. That’s a property containing a published indicated resource of over 40 million tons of lithium.

Work by previous operators at Cyr South has found the presence of several pegmatites on the property and surface samples have shown lithium, niobium, and tantalum.

So if Galaxy’s discovery up the road is any indication, along with some additional work on their own property, Medaro could be sitting on a prospective lithium property.

The team has completed preliminary work including soil and rock sampling and mapping.

Now, they’re just waiting on results from Phase 1 within the next month or two before finalizing their upcoming drilling plans.

With easy access to a major highway running through the property and a multi-service truck stop located nearby, this is an efficient setup for what looks like it could be a significant drill program.

Plus, add to that the potential to cut processing costs by another 30-50% using their technology, and we think this could be the beginning of a great opportunity to display their unique tech to the world.

But that’s not all Medaro Mining (CSE:MEDA; OTC:MEDAF) is holding in their back pocket. They’ve diversified even further with another key resource.

Tapping Into Another Global Shortage

While Big Tech has turned lithium shortages into a global headline, there’s another green energy resource that’s seeing renewed interest with the massive ESG push.

Today, nuclear power is playing a bigger and bigger role worldwide.

For example, China just announced plans to build 150 new nuclear reactors over the next 14 years.

That’s more nuclear reactors than we’ve built worldwide over the last 35 years.

And those reactors, both in China and in nuclear plants across the globe, will need uranium to power them.

With uranium already being in short supply as it stands, the increased demand could soon create a huge supply squeeze for uranium as well.

This is why Medaro Mining (CSE:MEDA; OTC:MEDAF) has diversified its holdings to include an option to acquire a new property near the only major uranium basin in all of North America, Canada’s Athabasca Basin.

The Athabasca has a long history of mining and development, and it’s well-known for being the highest grade uranium depository in the world.

Medaro’s Yurchison project covers 55,000 hectares of land, located just southwest and on-trend from the Janice Lake property under option to Rio Tinto for $30 million.

Medaro’s new project already had historical drilling done years ago, showing up to 0.3% uranium.

And as they continue to move ahead with the Yurchison project, we think this alone could lead to potentially significant profits if exploration goes according to plan and the results support commercial development.

Get Ready for the Lithium Boom

With some of the biggest companies in the world – Tesla, Ford, GM, Volkswagen, and more – shifting to electric vehicles, the pressure is on the mining industry to find an answer for the lithium shortage.

And if all goes well in the coming months, Medaro’s technology could play a significant role in helping supply lithium for the EV boom.

At this point, Medaro Mining (CSE:MEDA; OTC:MEDAF) may still be a relatively unknown company.

But with the potential to license their proprietary technology out to other lithium companies across the globe, the upcoming months could prove to be very important for both Medaro and the tech industry.

Other companies to watch as this space takes off:

Toyota Motor Corporation (NYSE:TM) has developed a fuel cell system module and looks to start selling it after the spring this year in a bid to promote hydrogen use and help the world achieve carbon neutrality goals, the world’s largest car manufacturer said in February.

According to Toyota, the new module can be used by companies developing fuel cell (FC) applications for trucks, buses, trains, and ships, as well as stationary generators.

The fuel cell system module can be directly connected to an existing electrical instrument provided with a motor, inverter, and battery, Toyota said today, noting that the modularization significantly improves convenience.

“In addition to its effort to popularize FCEVs, Toyota will continue to strengthen its initiatives as an FC system supplier to promote hydrogen utilization through the popularization of FC products together with various FC product companies with the aim of reducing CO2 emissions to curtail global warming and to contribute to the achievement of carbon neutrality,” Toyota said in its statement.

Honda Motors (NYSE:HMC) is another widely known automaker making major moves in the electric and hydrogen vehicle market. As one of the world’s most valuable automakers, the company is a force not to be ignored. Honda offers a variety of safe, eco-friendly vehicles to suit consumers’ needs such as fuel-efficient commuter vehicles or sporty coupes. Though Honda doesn’t capture as much of the fuel cell market as its biggest competitors, Toyota and Hyundai, it’s still worth keeping an eye on because its hydrogen vehicle production will only grow from here with President Joe Biden’s upcoming multi-trillion dollar green energy push.

Honda is a stock that is as consistent and reliable as its cars. Though its had its ups and downs throughout its history, it’s a strong dividend player and a veteran in the industry. And thanks to its environmentally friendly approach to the automotive sector, it could emerge as a surprise winner in the global energy transition.

In a recent release, Wabtec announced a partnership with General Motors (NYSE:GM) where GM would provide “electric batteries and hydrogen fuel systems” for Wabtec’s trains. These deliveries could begin within the next two years, and could potentially transform the entire industry. This move comes as part of GM’s wider shift towards alternative engine production, including fuel cells powered by hydrogen gas and electric vehicles.

GM is one of the most respected and recognized automakers on the planet, and now they are branching out and ditching internal combustion engines, other legacy automakers will likely follow suit. Though General Motors has been around for a long time, this is a turning point for the company. They’re making their best efforts to curb emissions, and it will likely pay off over time. Not only will it keep older shareholders happy, it could draw in new investments from more ESG-focused investors.

Ford (NYSE:F) is another old-school automaker taking the dive into greener waters. In addition to brand-new electric versions of its best-sellers, the F-150 and iconic Mustang, it’s also carving out its own position in the hydrogen race, as well. In fact, it recently even unveiled the world’s first-ever fuel cell hybrid plugin electric vehicle, the Ford Edge HySeries.

“This vehicle offers Ford the ultimate in flexibility in researching advanced propulsion technology,” said Gerhard Schmidt, vice president of research and advanced engineering for Ford Motor Company. “We could take the fuel cell power system out and replace it with a down-sized diesel, gasoline engine or any other powertrain connected to a small electric generator to make electricity like the fuel cell does now.”

Thanks to its green pivot, Ford’s stock price has soared since the beginning of 2021. Since the beginning of the year, the company’s share price has climbed from $8.52 to today’s price of $19, representing a more-than-100% increase in value.

Plug Power (NASDAQ:PLUG) is already providing its hydrogen-powered tech solutions to big names like Walmart and Staples, but the company has just made a huge leap in expanding its reach. With giant BlackRock’s Larry Fink jumping into the game headfirst last week with an investment of $26 million dollars. His reasoning? Plug’s innovative technology offers both stability and sustainability for retailers across North America who are eager to satisfy customers demanding environmentally friendly options as well as meet regulations requiring emissions reductions by 2040

Recently, Plug also announced a brand new green hydrogen plant that will serve customers across the southeastern United States. Producing 15 tons of liquid green hydrogen per day, the plant, powered by 100% renewable energy, will be a game changer for the region.

Andy Marsh, CEO of Plug Power noted, “With this hydrogen production plant, we are expanding our green hydrogen network to provide zero-emissions fuel to customers in Georgia and across the Southeast,” adding, “Investing in Camden County is the right choice to support Plug Power’s continued growth.”

Westport Fuel Systems (TSX:WRPT) isn’t a lithium play, but it is an important company to watch in the global energy transition. Especially as the world races to leave behind traditional gasoline and diesel-powered vehicles. Because it is a manufacturing play at heart, it is a unique way to get in on the boom in the alternative fuel auto industry.

Westport Fuel has been making major moves in the market over the past year, and its efforts are finally coming to fruition. Since February 2020, the company has seen its stock price rise by 348%, and with more potential deals like the one it has just sealed with Amazon to provide natural gas-powered trucks to its fleet, the stock has even more room to run in the coming years.

Canada’s renewable energy push is gaining speed, as well. Boralex Inc. (TSX:BLX) is one of Canada’s premier renewable energy firms. It played a major role in kickstarting the country’s domestic renewable boom. The company’s main renewable energies are produced through wind, hydroelectric, thermal and solar sources and help power the homes of many people across Canada and other parts of the world, including the United States, France and the United Kingdom.

Polaris Infrastructure (TSX:PIF) Is a Toronto-based renewable energy giant with a global footprint. The company’s biggest projects are in Latin America. It’s Nicaragua geothermal project, for example, is already producing over 77 MW of renewable electricity. And in Peru, its El Carmen and 8 de Augusto power plants, is set to produce a combined 17MW of electricity in the near future.

While renewable providers clearly take the lead, Canada’s tech and telecom giants won’t be left out!

Shaw Communications Inc (TSE:SJR.B) is one of Canada’s leading telecom infrastructure and cloud service providers. Its dominance in Canada’s telecom sector means that if any internet-based services want to operate, they’ll likely be utilizing the company’s infrastructure. After all, without telecoms, these TaaS companies would not be able to operate. And that’s not necessarily a bad thing when you consider Shaw’s sustainability goals. In fact, it is one of the biggest customers of Bullfrog Power which sources its electricity from a blend of wind energy and hydropower. It is also building its own portfolio of clean energy investments.

BCE Inc (TSX:BCE)) is another Canadian telecom giant going to great lengths to reduce its carbon footprint. For the past 25 years, BCE has been at the forefront of the environmental movement. Their environmental management system (EMS) has been certified to be ISO 14001-compliant since 2009.

By. Charles Kennedy

*IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

This news release contains certain forward-looking statements within the meaning of applicable securities laws. All statements that are not historical facts, including without limitation, statements regarding future estimates, plans, programs, forecasts, projections, objectives, assumptions, expectations or beliefs of future performance, are forward-looking statements. Forward-looking statements in this material include the Medaro Mining Corp. (the “Company”) joint venture (JV) with Global Lithium Extraction Technologies Inc. to develop a proprietary method of lithium extraction; that the Company will succeed in the development and commercialization of the proprietary technology to extract lithium which is highly cost effective, efficient and clean; that the Company will be able to earn its option to acquire ownership in its lithium projects; that the Company’s lithium projects will have commercial amounts of lithium which may be extracted and developed using its proposed technology or otherwise; that the market for lithium will continue to grow to billions of dollars; that the Company will be able to produce sufficient quantities of lithium to supply major contracts worldwide or be otherwise able to commercialize its business; that the Company’s JV will be able to develop, commercialize and license the technology on a global scale; that the technology will be able reduce extraction costs by up to 50%; that the technology will be implemented in remote areas close to productive mines; that the Company will design processing facilities for lithium extraction using the technology developed by the JV; that the technology will be able to extract commercial amounts of lithium; that the Company will be able to earn its option to acquire ownership in its uranium project; that the Company’s uranium project will have commercial amounts of uranium which may be developed; . Forward-looking statements are subject to a number of risks and uncertainties, which may cause actual outcomes to differ materially from those discussed in the forward-looking statements. Risks that could change or prevent these statements from coming to fruition include that the Company’s JV may be unable to successfully develop a proprietary method of lithium extraction; that the Company may be unsuccessful in the development of its proposed technology, or even if developed, that the Company may be unable to commercialize the technology or otherwise be able to extract lithium by a method which is cost effective, efficient or clean; that the Company may fail to be able to develop lithium extraction facilities or to license its technology; that the Company may fail to fulfill its obligations under its option agreements in respect of its lithium and uranium projects and be unable to acquire ownership in the properties; that the Company’s lithium and uranium projects may be fail to have any or sufficient commercially viable amounts of lithium or uranium which may be extracted and/or developed; that the market for lithium may not grow as quickly or as much as anticipated; that the Company may not be able to finance its intended development of technology and/or the maintenance/development of its lithium and uranium properties; competitors may offer cheaper or better products; markets don’t develop for the products as expected; intellectual property rights may not protect the Company’s processes and the Company’s technology may infringe on the intellectual property of others; and the Company may not be able to carry out its business plans as expected. The forward-looking information contained herein is given as of the date hereof and the writer assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

ADVERTISEMENT. This communication is for entertainment purposes only. Never invest purely based on our communication. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively, “Oilprice.com”) are being paid ninety thousand USD for this article as part of a larger marketing campaign for CSE:MEDA. This compensation is a major conflict with our ability to be unbiased. This communication is for entertainment purposes only. Never invest purely based on our communication. The information in this report and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendations.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.

Related posts:

Views: 0

RSS Feed

RSS Feed

December 6th, 2021

December 6th, 2021  Awake Goy

Awake Goy  Posted in

Posted in  Tags:

Tags: