Reuters l Giorgos Beleris: Iran’s economy has diversified over the past several decades since the imposition of sanctions against the nation in the late 1970s and early 1980s. Nevertheless, oil/petroleum continues to account for approximately 80 percent of the country’s exports. In addition to supporting Iran’s gross domestic product (GDP), the production of oil is also essential for fueling its industrial development and providing much-needed electricity and heat to the nation’s nearly 80 million people.

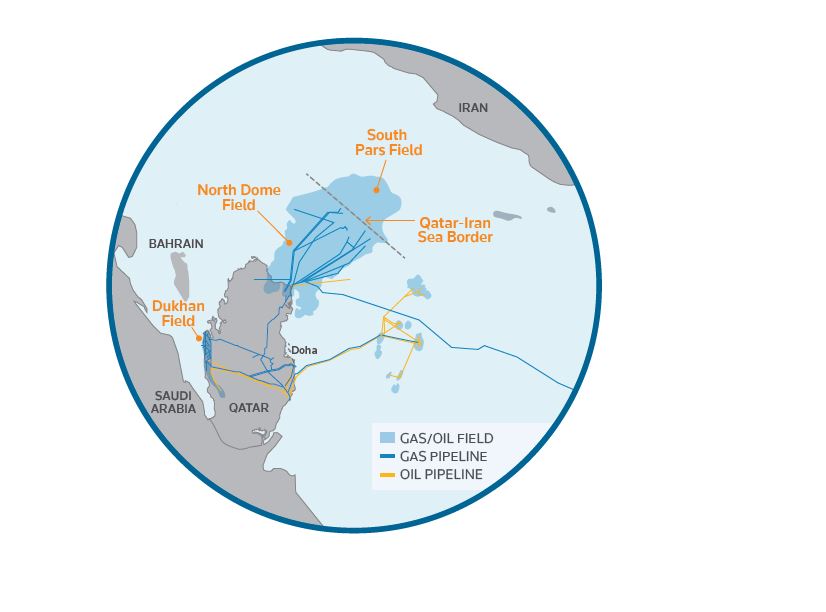

International sanctions against Iran were lifted in 2015, paving the way for the potential for increased trade and exportation of Iran’s fossil-fuel products. The removal of sanctions also opened the door to new business partners in the nation. For example, France’s Total signed a 20-year contract with the National Iranian Oil Company (NIOC) to develop a resource-rich field called the South Pars, a shared natural gas condensate field owned jointly by Iran and Qatar.

The South Pars/North Dome field is thought to be the world’s most plentiful natural gas field. The two nations have jointly shared it since the late 1980s as part of a long-standing, deeply rooted relationship. Al Jazeera reports, “This field plays a central yet often underrated role in the development of foreign and national policies in both Qatar and Iran. In light of this, any attempt for isolation or pressure on either country to alter select policies is futile insofar as it disregards this fact.”

Total’s investment in Iran, coupled with the earlier removal of sanctions and expansion into liquefied natural gas (LNG), help the geopolitical ambitions of the current Iranian regime in attracting new business and fostering domestic growth. Iran aims to be a more significant contributor to the global LNG trade, alongside nations like Russia, the United States and Qatar. With these factors in mind, we provide a deeper understanding of Iran’s oil-export profile and the regions with which it is collaborating.

Iran increases its oil exports

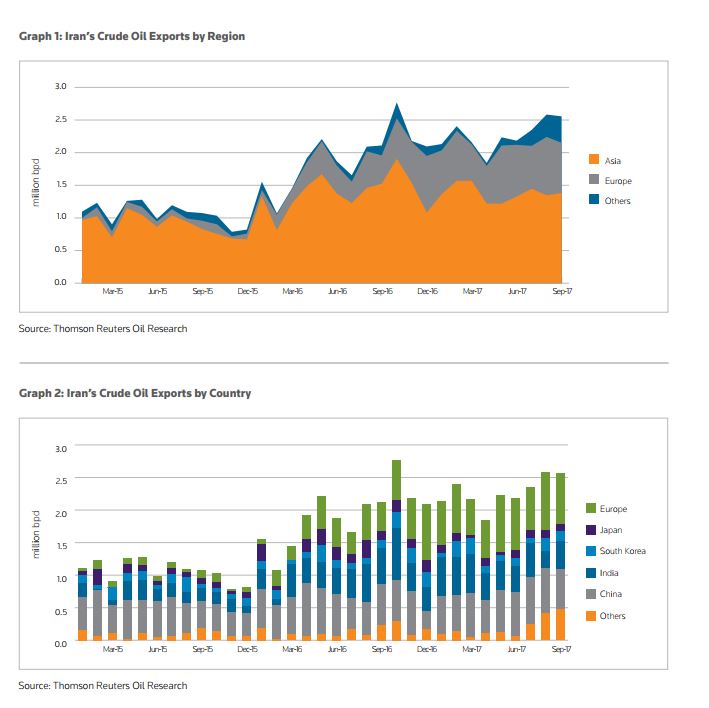

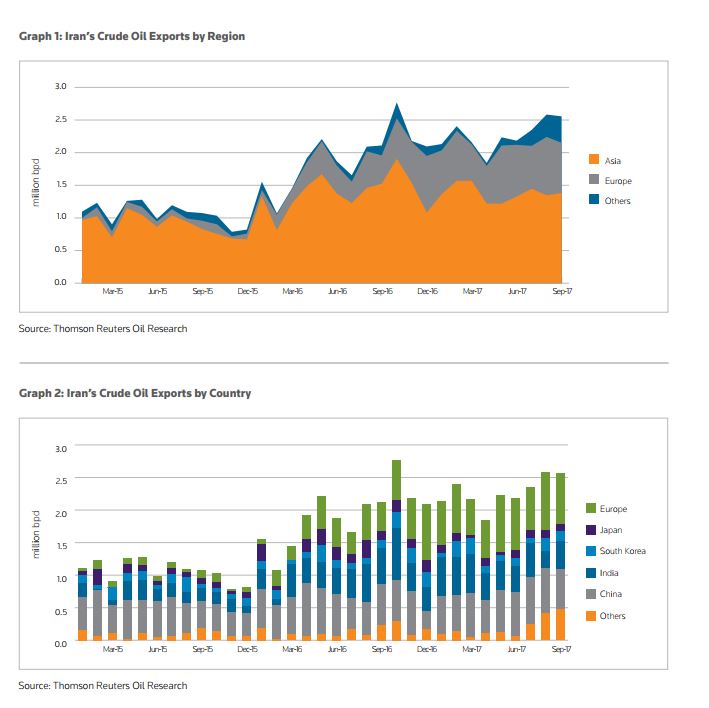

Iran’s oil exports nearly doubled in the period between December 2015 and January 2016, when the country was given the green light to freely market its petroleum under a deal with the P5+1, which laid out restrictions on nuclear development. (The P5+1 are the five permanent members of the UN’s Security Council: China, France, Russia, the UK and the U.S., plus Germany.) Iran rapidly increased exports of crude oil above the 2 million barrels per day (bpd) mark, effectively doubling quantities compared to the period when sanctions were in place. Exports have consistently remained above 2 million bpd for the last year, as shown in Graph 1, with the exception of April 2017 when they dipped to 1.84 million bpd.

The South Pars/North Dome Gas Condensate Field, jointly shared by Iran and Qatar, is considered to be the world’s most plentiful natural gas field.

Crude oil exports peaked in October 2016 at 2.77 million bpd, largely due to a sharp rise in demand from India and European countries, which reached 811,000 bpd and 621,000 bpd, respectively. Exports to Europe continued to grow after October 2016 as old clients, predominantly in the Mediterranean region, became increasingly more interested in sourcing additional quantities of Iranian crude. However, at the same time, interest from India began to decline as Iranian crude oil volumes were replaced by Saudi and Iraqi quantities despite relatively stable pricing, while volumes from Iran dropped below 300,000 bpd in December 2016.

Interestingly, crude oil exports from Iran to India have not recovered to the October 2016 highs, as shown in Graph 2, given the fact that India’s bid to develop an offshore natural gas project was denied by Iran, potentially jeopardizing the relationship between the two countries. This is in contrast to the strong trade links maintained by the two nations throughout the sanctions period as crude oil continued to find its way from Iran to India.

Floating inventory

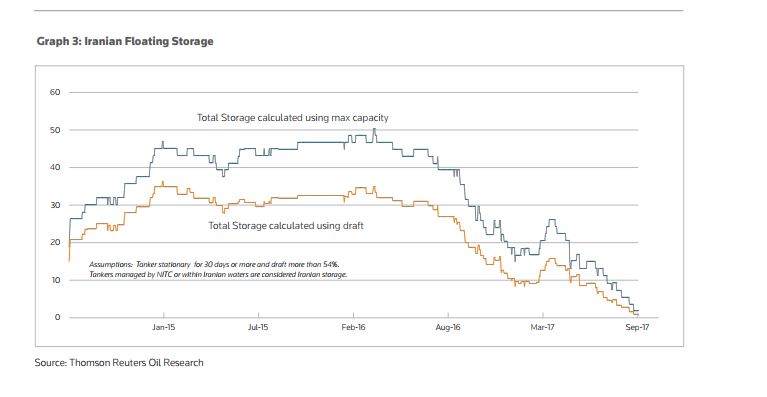

Notably, Iran had built a sizable floating inventory of crude oil in vessels which, for the most part, are owned by the National Iranian Tanker Company. However, there are currently minimal quantities of crude oil in this floating storage, as depicted in Graph 3.

The drawdown of floating storage to maintain exporting levels suggests that production may have faced challenges during the same period as the need for investments is growing. Iranian crude-oil-output potential is limited as the producing fields need enhanced recovery projects. These projects require the technical and financial support of international oil companies (IOCs). In addition, the country’s fiscal circumstances are lacking desired conditions for some foreign investors. Greenfield developments like the West Karoun fields are having myriad challenges due to a lack of technical capabilities and investment, as well as problems in Iraq, the joint operator for the West Karoun project.

Condensate oil conditions

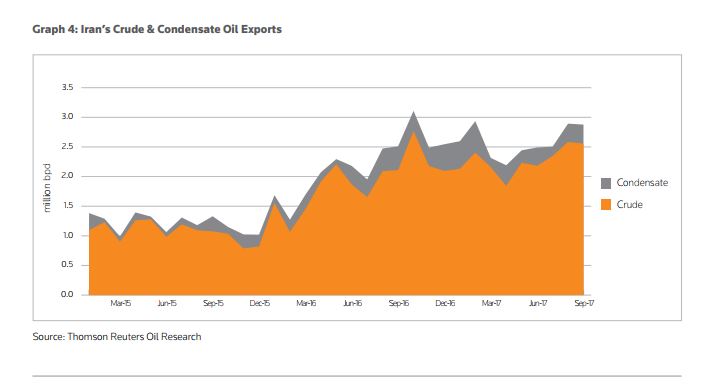

Iran has struggled to lift exports of oil above the October 2016 level despite competition from Asian buyers remaining strong. The country’s combined crude and condensate oil exports are consistent and likely to offer a significant boost to the country’s economy in the post-sanctions era.

Condensate exports have stayed strong (as shown in Graph 4) with Asian demand offering significant support and petrochemical processing units in the Far East continuing to be keen buyers. It’s also important to note that the country’s condensate output potential is supported by its increasing gas-production capacity. Unlike oil sales, Iranian gas sales are secured with term contracts, enabling Iran to ramp up gas production and thereby condensate output capacity. The South Pars Development region, Iran’s major condensate production area, is projected to produce approximately 530,00 bpd of condensate in 2017, representing a 3 percent year-over-year increase.

Iran’s challenges in opening oil reserves for foreign investment are not only a function of current oil market conditions, but also of its domestic political issues. It is very unlikely that the speed of attracting IOCs will be greater than expected in light of the current price situation and demand recovery.

If there were to be a global crude oil demand recovery, the drawdown of additional Iranian barrels could be replaced by other producers, mainly from Russia and Iraq, as both nations have the potential to fill the gap. Unless there is another unexpected disruption in Iranian oil supply, as happened with the U.S. sanctions, the effects to the global supply would be minimal.

Iranian oil is not in the free market as it is produced, priced and traded by the National Iranian Oil Company. The buyer companies are mainly other national oil companies (NOCs) in the importing countries. This is the standard approach for Asian buyers.

Iran’s current situation with India is a good example of this. IOCs and trading companies are on the buyer side for European deliveries. Iran’s plans to build refineries and petrochemical plants within Europe are an attempt to change this dynamic and create a cushion for any potential future sanctions. From this perspective, Iran is expected to maintain good relationships with Asian-buyer countries, and the relations with European countries are expected to be minimally affected by these oil sales.

Source Article from http://theiranproject.com/blog/2018/02/02/lifting-sanctions-oil-flows-iran/

Related posts:

Views: 0

RSS Feed

RSS Feed

February 2nd, 2018

February 2nd, 2018  Awake Goy

Awake Goy  Posted in

Posted in  Tags:

Tags: