It will be CBDC, a digital control system, or even a modern enslavement system. This article reviews progress of CBDC projects worldwide, under BIS & IMF’s leadership.

AUG 14, 2023

Originally written by me for Bereshit Newspaper, this is an edited version | Translated by Deborah Garber

The global trend towards centralized control over citizens is progressing simultaneously across several paths: in the cognitive path – through control of information and the media, strengthening censorship and silencing voices outside the mainstream; In the financial path – 114 pilot projects of central bank digital currencies (CBDC) are in gear around the world, ten countries have already launched their CBDC systems that allow the government to monitor every transaction, program and designate the use of money and set an expiration date for it. The collapse of US banks is helping to move citizens to larger banks, which is facilitating centralised control; In the field of emergencies – it seems that every day we wake up to a different emergency: health, security, climate, population density and more. Any such emergency allows any government to tighten the belt and violate our rights while imposing new taxes, sanctions or restrictions.

Amid all this, the powers that be ensure we hate anyone who is not with us and is not like us, we are being pushed to fear each other on any basis: our religion, nationality, sexuality, vaccination status, political, intellectual or any other background. “Divided we fall”, the saying goes. This way, as we already know, it’s easier to control us.

Whatever promotes independence, sovereignty or individual strength – such as using cash, adopting bitcoin or crypto, home schooling, natural births, recovery and treatment in a framework that is not “western medicine”, pluralism and discourse, informed choice and free choice – is made inaccessible, defined as dangerous or not recommended.

Join me and guests this Wednesday Aug. 16th at 10am EST, 4pm CET, 5pm Israel – for a Twitter Space about CBDC in Israel, UK & more. Watch the recording here.

The Challenge: How to Get the Public to Accept CBDC?

The Challenge: How to Get the Public to Accept CBDC?

This month, the Bank of Israel published a document called “Principles for creating acceptance and a network effect of the digital shekel”, in which it actually reveals the principles of its action plan and explains the ways in which it will be possible to ensure widespread adoption of the digital shekel and its use.

Those familiar with the high-tech world and experienced with applications and software, know that one of the biggest challenges in launching a technological product is the phase of adoption, usage and creating “stickiness”, that is getting users to “stick” to the application and use it regularly. Th qe solutions to these challenges are part of the careful planning of the product’s launch and distribution strategy, so that it reaches as many end users as possible, and of the planning of the enrollment strategy (called ‘onboarding’ in the technological parlance) to make it extremely simple and easy to operate.

The Bank of Israel and the digital shekel project team seem to be aware of this, and therefore are investing heavily in planning and addressing all the different aspects of the adoption stages, known as “acceptance”, enrollment and stickiness creation. In addition, their ambition is to reach a “network effect” – in simple terms, to create virality on the network. When dealing with a payment solution, virality and widespread adoption, if most or all the public does not adopt the product, the system will not be sustainable. Therefore, the document states: “The network effect will cause positive external effects in the use of the digital shekel, so that payment with it by a greater number of users will in itself lead to a wide distribution among the public.”

The document proves that the Bank of Israel understands that the adoption of the digital shekel will be challenging because the public may understand that a government payment system increases surveillance and control and eliminates privacy, and that adopting a technological solution is not easy these days, because of the competition from other technological payment solutions, cryptocurrencies, Bitcoin and certainly the use of cash. In addition, the older generation, already challenged by technology, may reject the digital shekel.

Strategies to Increase Engagement

The Bank of Israel is suggesting the following strategies to increase engagement and adoption. They are detailed here in a sequence of easy to demanding, or from recommendation to obligation:

- Encouraging direct payments between people – “Widespread use of the digital shekel as a means of making payments between individuals will result in businesses also having an incentive to respect it.”

- The experience of using the digital shekel must be easy and positive, with a convenient interface, using existing and well-known means of payment – through applications such as Bit and Paybox (digital payment apps), contactless payment via mobile phones, credit cards, or wearable technology (watches, bracelets).

- The government will be the first entity to demand and receive payments in the digital shekel – fines, fees, taxes, allowances, refunds and payments (as well as salaries) to the hundreds of thousands of employees in the public sector.

- Mandatory participation of banks and payment service providers – this is where the regulator’s coercion to comply comes in. If it chooses this route: “The Bank of Israel may adopt a policy that will oblige financial entities, and in particular the banks, credit card companies and essential payment service providers… to act as “payment providers” in the digital shekel system and provide customers with digital shekel wallet services.”

- Mandating businesses to participate – “If it is necessary to motivate the businesses to adopt the new payment method, it is possible that the state, through legislative procedures, will oblige the businesses that meet certain criteria to make the necessary adjustments to allow consumers to pay using the digital shekel.” In other words – laws will be enacted that will force businesses to trade in the digital shekel.

One of the sad jokes in the document is that just after the authors of the document revealed that they may force the banks and businesses to use the digital shekel, the next part of the document is called “business considerations in deciding to adopt a new payment method” – as if businesses would have the option to choose and could consider whether to adopt the digital shekel or not.

Programmable Payments

The last point in the document that catches the eye and cannot be ignored, is the decisive proof – black on white – that the digital shekel system (CBDC) is a system of technological control over the citizen. The proof comes in the paragraph about “Programmable Payments“:

“The motivation behind programmable payments is to include a certain logic in the payment process. For example, it can be determined that a payment will be made based on pre-defined rules or preferences – if condition X occurs, then payment Y will be made, for example:

- Money that can be used to make a payment only on the condition that the purchase of the product meets the definition of the law.

- Money that can only be used at certain times or dates.

- A payment that is made only when certain conditions are met. For example, after some task has been completed.’

If we needed more reasons to understand why the digital shekel system and in general all CBDC systems are dangerous, it seems they were provided in this document.

This fully aligns with the words of Eswar Prasad, former Head of the IMF’s China division, speaking at a World Economic Forum panel discussion in China. Prasad outlines how CBDCs will be programmable, such that governments will be able to severely restrict how, when, where, on what and by whom they can be spent, including the imposition of expiry dates:

Note About CBDC in Canada

Note About CBDC in Canada

Despite the fact that the Bank of Canada issued a paper in Nov. 2021 called “The Positive Case for a CBDC” – in which it lays out the reasons to launch CBDC, it has now published another paper which casts doubt on CBDC value. The paper’s authors note that most Canadians do not experience gaps in their access to a range of payment methods, and this would probably continue to be the case in a cashless environment. In my opinion, this could be a tactic on behalf of the Canadian central bank to normalize the use of existing payment methods as their mediator for CBDC. I guess we’ll have to wait and see where the wind blows in Canada’s CBDC skies.

”Project Eden” and the Digital Shekel Progress

”Project Eden” and the Digital Shekel Progress

The process of replacing the shekel with CBDC, which is not a currency at all but a technological control system, is progressing in Israel at an impressive rate. A new announcement from the Stock Exchange and the Ministry of Finance reveals the completion of the pilot project “Eden” – the issuance of the first digital bond on a government blockchain infrastructure, in line with the digital shekel infrastructure. The development positions Israel so that it may be the first in the world to launch a digital bond.

A press release from the Securities Authority states: “The ‘Eden’ system was designed with the aim of enabling the clearing of digital assets against various digital currencies, including digital currencies of central banks (CBDCs), this is in continuation of the many projects promoted around the world that examine the feasibility of integrating digital currencies into traditional financial systems”.

Progress of CBDC Projects Sponsored by the BIS

The technical feasibility of cross-border payments has been proven through various CBDC pilots, under the umbrella of the Bank for International Settlements (BIS), which is essentially the “big brother” of the world’s central banks, and as such it leads monetary policy and projects all over the world. In October 2020, Agustin Carstens, Director General of the BIS, said: “With CBDCs, central banks will have complete control over the rules and regulations that will determine the use and implementation of this method and the responsibility for it, and we will also have the technology to enforce it.”

Projects Jura & Dunbar

In 2021, a pilot named “Project Jura” of the BIS and the central banks of France and Switzerland was successfully completed, and in March 2022, the “Dunbar Project” of the BIS and the central banks of Australia, Malaysia, Singapore and South Africa was completed.

Sela Project

In June 2022, the BIS “Sela Project” was launched with the Bank of Israel and the Hong Kong Monetary Authority, within which the feasibility of a retail digital currency of the central bank (retail CBDC) was being tested. This project reduces the role of banks as intermediaries between the central bank and the end customer to the minimum necessary, and mainly focuses on making the technological service more accessible, which should be more resistant to sophisticated cyber-attacks. In other words, this project tests the feasibility of creating direct payment and banking relations between the central bank and the citizen.

Icebreaker Project

In March 2023, “Icebreaker Project” that included the central banks of Israel, Sweden and Norway was completed, and demonstrated the feasibility of international retail use of CBDCs.

The Governor of the Bank of Israel, Amir Yaron, said in January 2023 in his speech at the World Economic Forum in Davos that we are in the midst of a technological revolution in payment systems with the help of CBDCs for “public good”, while he refers to the achievements of Project Icebreaker: “A complete matrix of all currencies against all currencies is required, a system that will be agile enough… and it seems that this system is able to do it.”

It is interesting that this revolution is being broadcast from platforms of global forums around the world, yet has not reached the homes of Israeli citizens who are blissfully unaware of it.

Project mBridge

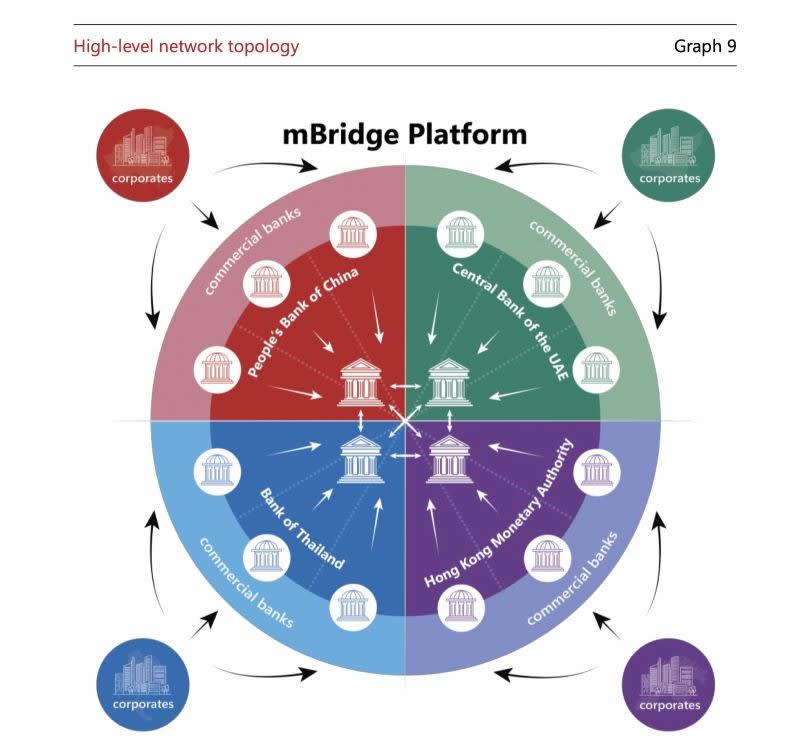

A similar pilot called “Project mBridge” ended in late 2022 and received positive reviews after making $22 million worth of cross-border wholesale transactions in six weeks. The BIS connected about 20 banking regulators and commercial banks from Hong Kong, China, Thailand, and the United Arab Emirates in this project. The BIS website states that “the global network of banks that enables international payments (referring to the SWIFT network, E.F) is impeded by high costs, low speed and transparency and operational complexity. The banks in this network also monopolise networks and services and leave many participants without sufficient or affordable access to the global financial system”.

A clear trend in recent years is “de-dollarization” – whereby countries have increased their trade in currencies other than the US dollar, to reduce dependence on it. Trade agreements have been made between China and Russia to trade oil in yuan and ruble, and Saudi Arabia recently showed a willingness to sell oil to China in yuan and not in dollars. Owing to sanctions and political interests, certain countries cannot participate in global trade or money transfers on the SWIFT network, and therefore the need to create an alternative for transferring money between countries independent of the dollar is increasing – another incentive for BIS to promote the mBridge project.

It is important to note that the BRICS group of countries (Brazil, Russia, India, China and South Africa) has been growing stronger recently, and today 20 countries are seeking to join the BRICS, a fact that undermines the hegemony of the USA as the dominant global power.

The IMF Joins the Race to CBDC

While the BIS is racing towards its goals, the IMF (the International Monetary Fund) which is positioned second in the hierarchy beneath the BIS, announced this week that it is working on a global platform for central bank digital currencies (CDBCs) to enable transactions between countries: “CBDCs should not function at a national level,… in order to have more efficient and fairer transactions, we need systems that connect countries,” said the Managing Director of the IMF, Kristalina Georgieva, at a conference in Morocco. The goal is agreement amongst central banks on a common regulatory framework for digital currencies, which will enable mutual and global action. “Disagreement on a common platform will create a vacuum that will probably be filled by crypto-currencies,” said Georgieva. And it is known that the adoption of non-government currencies is, of course, dangerous and wrong (I’m clearly being cynical).

To be fair, I’ll mention the advantage of CBDCs: they can help reduce costs and transaction speeds. But why no emphasis is placed on the potential dangers and harms to individual citizens who will be trapped in this modern financial enslavement system? Simply because those who design, create, and manage these CBDC projects don’t perceive them as detrimental. For them, central control is essential and is a sign of progress. There’s no better time to think about and act on your financials… gain knowledge if needed, distribute & decentralize your wealth as much as possible, transfer fiat currency (which will turn to CBDCs soon) to precious metals (I prefer physical) such as gold and silver, and of course get yourself some Bitcoin, if you haven’t already.

—End

Bahamas Sand Dollar & China’s e-CNY Projects

Read more about these rolled out projects in the blog below:

a year ago · 10 likes · 3 comments · BowTiedScholar

What’s CBDC and the Chinese e-CNY CBDC Project Progress

Check out my Twitter thread about CBDC, and join me on Oct. 12-13 in Amsterdam for the Bitcoin Conference, where I’ll be speaking about CBDC.

https://efrat.substack.com/p/soon-your-money-wont-be-money-and

_______________________________

The Time for Silence is Over

https://www.uncoverdc.com/2022/10/21/a-message-to-humanity-the-time-for-silence-is-over/

A unified pushback against the globalist agenda

One step at a time, hand in hand, we are walking out from the globalist society they are trying to enslave us into

ANYONE can participate

ANYWHERE in the world

JOIN or read about it here – https://globalwalkout.com

https://www.reignitefreedom.com/

The third step is to unsubscribe from all mainstream media outlets. Delete the apps from your phone, laptop, and tablet and unfollow all of their social media and YouTube channels. Try to avoid mainstream media for at least one week, even if the headline is intriguing.

In the same time why not removing all the big tech tracking/spying/social credit system around you: (Youtube, Facebook, Instagram, Twitter, Tik Tok, Google, Apple, Microsoft, Whatsapp, Zoom, Linkedln, Snapchat, Tumblr, Pinterest, Reddit, Myspace, etc.)

The fourth step of the global walkout is to move as many accounts as you can to a union or local bank.

If you like our work please consider to donate :

_______________________________

If you are looking for solutions (lawyer, form, gathering, action, antidote, treatments, maybe this could help you:

HERE

If you want to fight back better:

https://childrenshealthdefense.org/child-health-topics/health-freedom/defender-days-sticker-gallery/

Find the others: www.freedomcells.org

Spike Protein Protocol

McCullough MD (aug 2023):

He recommended three supplements to mitigate harm and degrade spike proteins:

1. Nattokinase – 2000 units twice a day. Breaks down spike protein.

2. Bromelain – 500 milligrams once a day. Also breaks down spike protein.

3. Curcumin – 500 milligrams twice a day. Reduces inflammation and spike protein damage.

Urotherapy https://urotherapyresearch.com/ https://rumble.com/v2wsgmv-dir-ep8-heal-your-mitochondria-with-urotherapy-and-cutting-edge-regenerativ.html

Glutathione (most important for body detoxification) or better

NAC = N-Acetyl-Cysteine 600-750mg (causes the body to produce glutathione itself)

Zinc

Astaxantin 5mg (also improves vision)

Quercetin

vitamin D3

Milk thistle (also liver and stomach protection)

Melatonin 1mg to 10mg (against 5G)

Alternatively CDS/CDL and zeolite

Myocarditis: Nicotine

Dr. Zelenko’s Protocol contains Ivermectin, Hydroxychloroquine (HCQ), Zinc, Vitamin D3, and Quercetin.

Fasting cures everything!

How to find the truth :

Search engine: https://presearch.org/, https://search.brave.com/, Searx (choose the server that you want) or https://metager.org/

Videos: www.odysee.com

www.bitchute.com

www.brandnewtube.com

Facebook style: www.gab.com or https://www.minds.com/

INTELLIGENCE ISN’T KNOWING EVERYTHING, IT’S THE ABILITY TO CHALLENGE EVERYTHING YOU KNOW

Related posts:

Views: 0

RSS Feed

RSS Feed

October 6th, 2023

October 6th, 2023  Awake Goy

Awake Goy  Posted in

Posted in  Tags:

Tags: