The setup for higher silver prices is so good it’s scary. The relative positioning of speculators versus the bullion banks in the futures markets is extraordinarily lopsided.

A bet on silver moving higher from here looks a lot like a no-brainer. So much so that David Morgan, publisher of The Morgan Report and silver guru is advising just a bit of caution, as he told listeners in an exclusive interview on this past Friday’s Money Metals Weekly Market Wrap Podcast.

The bullion banks (Commercials) are almost certainly now betting for higher silver prices and have relinquished their concentrated short position.

Meanwhile, the large speculators are positioned increasingly short. The good news for silver bulls is the bullion banks dominate the futures markets, by hook or by crook, and they generally win versus the speculators.

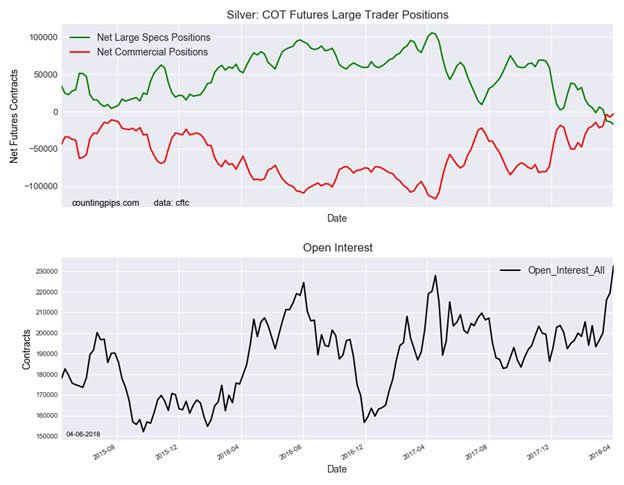

In the chart below from Zachary Storella (Investing.com), the red line represents the “Commercials” which are the bullion banks and miners. It shows their collective position virtually even, or neutral. It is the first time this has happened since the Commodity Futures Trading Commission began publishing the more detailed Commitments of Traders report in 2009.

One could argue that if the commercials are neutral, that isn’t exactly the same as the bullion banks being positioned long.

One could argue that if the commercials are neutral, that isn’t exactly the same as the bullion banks being positioned long.

Remember though, the commercial category includes both the producers and the bullion banks. Miners are generally going to be short by default. It is typical for them to hedge their production by selling futures and delivering the physical metal later. This hedging allows them to raise funds for current operations and protect themselves from a drop in metals prices down the road.

If the miners are short, the bullion banks have to be betting long.

Meanwhile, the speculators are taking the other side of that bet. If history is going to repeat and the banks are going to once again take the specs back to the woodshed for a whipping, it is full steam ahead for silver prices, right? Not quite so fast says David Morgan.

The problem is in the lower of the two charts shown above. Open interest in silver — the number of open futures contracts — is near record highs.

In the past, when the commercial short position approached a bottom, open interest also tended to be near a low point

We are in uncharted territory with both an extreme in Commercial/Spec positioning and an extreme in open interest. That makes predictions about the direction of the price more uncertain.

The COT report isn’t detailed enough to remove all guesswork about how the banks are positioned, so there could be something important that silver bugs are missing.

But if the prop traders at JPMorgan Chase and the other banks who dominate metals trading are positioned heavily long, the huge open interest could fuel a dramatic move in price. If prices start moving higher, there are a lot of specs to be caught in a short squeeze.

Another bit of data supports the notion that silver investors are witnessing history in the markets with the bullion banks FINALLY long silver.

Craig Hemke, of TF Metals Report, noted on Friday that JPMorgan Chase added another 605,000 ounces of physical silver to their COMEX vault. That bank has been notorious for its short position, but it has been steadily building a physical position in recent months. Today it holds a whopping 53.7% of the COMEX bar inventory.

All of this extraordinary positioning in the futures markets could be foretelling something extraordinary is about to happen to the silver price.

Clint Siegner is a Director at Money Metals Exchange, the national precious metals company named 2015 “Dealer of the Year” in the United States by an independent global ratings group. A graduate of Linfield College in Oregon, Siegner puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals’ brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.

Source Article from http://feedproxy.google.com/~r/ActivistPost/~3/5tfBlXBB2fg/silver-may-be-getting-ready-to-shine-again.html

Related posts:

Views: 0

RSS Feed

RSS Feed

April 10th, 2018

April 10th, 2018  Awake Goy

Awake Goy

Posted in

Posted in  Tags:

Tags: