Without China’s participation in joint efforts in debt restructuring, it is not possible to quickly ease the burden on many debt-distressed countries. However, even if not impossible, it is a difficult task.

Some may think that the debt default of Sri Lanka is a far-flung problem in a distant land. However, this is far from the case for many reasons. Given that this affects food security and basic needs, protecting people’s fundamental human rights must be a concern to us all. In Sri Lanka, one in three households is food insecure and people struggle to obtain essential medicines, as basic as painkillers. Political instability exacerbates the situation.

Moreover, Sri Lanka owes many creditors, including US and Europe-based institutional investors, the Asian Development Bank, the World Bank, China and Japan. These creditors are not receiving their money back and, thus, cannot provide credit to other countries in need.

Finally, a debt crisis in any given country can spiral out of control and impact the entire financial system. Remember how the Greek debt crisis affected the European Union (EU), the US and several other countries. This risk also applies to Sri Lanka.

OPINION: What can we expect from this year’s World Economic Forum?

Lending a helping hand to Sri Lanka

Some of the reasons mentioned above led the International Monetary Fund (IMF) to step in. In September 2022, the IMF reached a staff-level agreement with Sri Lanka, providing funding of about $2.9 billion. Such financing was destined to restore the country’s financial and economic stability. However, the IMF conditioned funding upon receiving financing assurances from Sri Lanka’s official creditors. In March 2023, all Sri Lanka’s major creditors, including China, gave the country financing assurances. Therefore, the loan will be considered by the IMF Executive Board, which constitutes great news for Sri Lanka to deal with its default.

But Sri Lanka is just one country that is going through financial problems. About one-fifth of low-income countries are estimated to already suffer from debt distress, and half of the low-income countries are in danger of it. This means the risk for the financial system is greater than thought. This also means countries and financial institutions should, without delay, collaboratively act upon the debt distress and debt unsustainability problems. In other words, governments and financial institutions should go beyond geopolitical disputes and find a way to create a functioning forum for discussion on debt restructuring, which must include China – a major creditor.

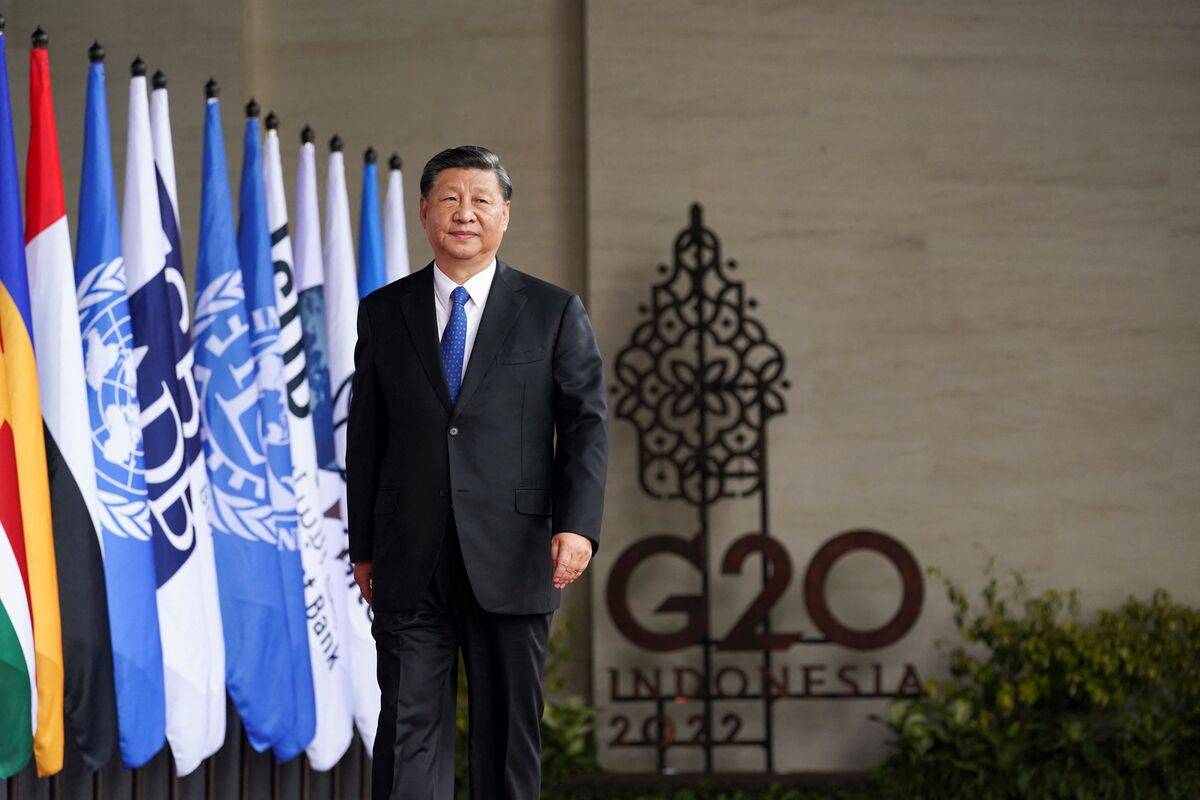

China: A key actor in saving many

China is a significant creditor, which many underdeveloped nations appreciate because Beijing has less extensive conditions than other creditors, including the IMF. Moreover, China grants loans more quickly than other creditors. As a result, China is a major creditor of several African countries. Many of the latter are on the brink of debt distress.

READ: China’s Wang Yi – Saudi, Iran restoration of ties a ‘victory for dialogue’

This is why China should be a part of a functioning and collaborative forum comprising major creditors, including the Paris Club members. But this goal is challenging and was tried before to no avail. For example, the G20 Common Framework for Debt Treatments adopted a similar plan. Countries, including Zambia, Ghana and Chad, applied to be part of the framework. However, this group was ineffective and dysfunctional, as its members had little in common. Consequently, they could not implement the decisions they agreed on.

A similar problem could arise again in collaborative forums that include China. Beijing’s reluctance to cooperate and disclose its lending terms will complicate things. Creditors’ different approaches to debt restructuring, such as write-downs and maturity extensions, are another persistent problem.

Is there a light at the end of the tunnel?

Still, there is hope. China and other creditors managed to somehow work together in Zambia’s debt restructuring process. The same is now happening with Sri Lanka. This shows that creditors can benefit from their Zambia and Sri Lanka experiences and conduct the debt restructuring process in a coordinated, timely and effective manner. Otherwise, people living in those nations will suffer deeply, and those with close relations with them will also suffer, destabilising the system and jeopardising the world’s economy.

In an integrated world economy, there is no faraway problem in a distant land. Therefore, we should all be concerned, and all major creditors should not hesitate to swiftly take action to facilitate debt restructuring processes.

OPINION: A new order: What we should learn from COP27 and the G20 Summit

The views expressed in this article belong to the author and do not necessarily reflect the editorial policy of Middle East Monitor.

Related posts:

Views: 0

RSS Feed

RSS Feed

March 18th, 2023

March 18th, 2023  Awake Goy

Awake Goy

Posted in

Posted in  Tags:

Tags: