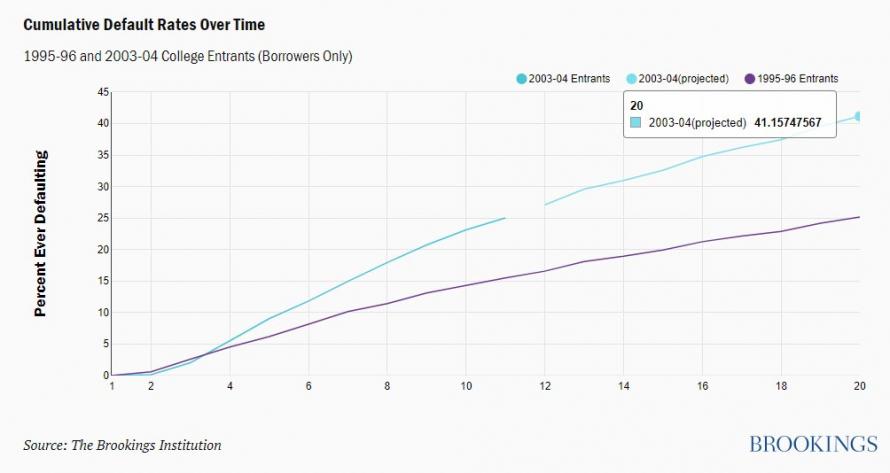

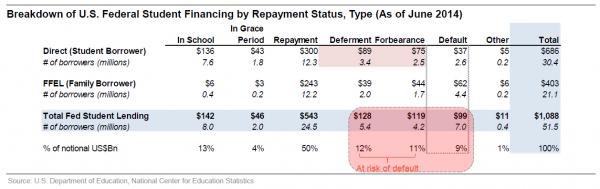

Over three years ago, when the full extent of the student debt crisis was becoming apparent, the Treasury Borrowing Advisory Committee released a startling analysis and long-term forecast which showed two things: i) up to a third of all student loans are likely to end up unrepaid…

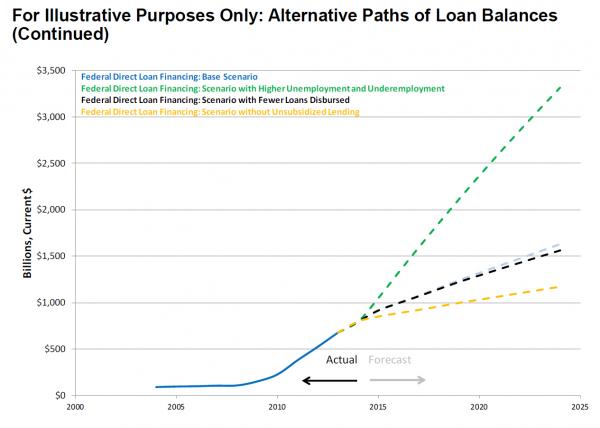

… and ii) the total amount total student loans, which currently amount to $1.48 trillion (nearly 50% more than all the credit card debt in America), is set to hit a whopping $3.3 trillion by 2024.

Something strange is going on in the financial system. And according to The Wall Street Journal, it’s causing some investors to move massive amounts of money out of the banking system.

Fast forward to this week, when a Brookings Institution report offered a new set of dire observations suggesting that “the looming student default crisis is worse than we thought.”

The analysis “suggests that nearly 40% of borrowers may default on their student loans by 2023,” a staggering number if one assumes the TBAC’s forecast that there will be roughly $2.5 trillion in student loans outstanding by 2020 (see chart above). It would mean that no less than $1 trillion in student loans will be in some form of default in two years, an outcome which will necessitate another indirect, if ultimately taxpayer funded bailout from the US treasury: recall that the vast majority of student debt is currently issued by the US government.

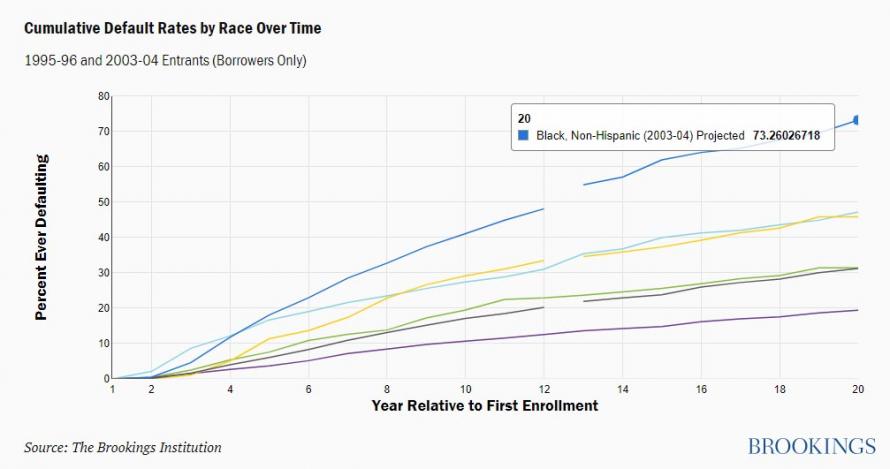

But while the overall rise in student loan defaults in coming years is hardly a surprise, a more troubling observation made by author Judith Scott-Clayton is that debt and default among black college students “is at crisis levels, and even a bachelor’s degree is no guarantee of security: black BA graduates default at five times the rate of white BA graduates (21 versus 4 percent), and are more likely to default than white dropouts.”

The Brookings study also found that the worsening default pattern is most acute at for-profit colleges: out of 100 students who ever attended one, 23 defaulted within 12 years of starting college in 1996 compared to 43 of those who started in 2004. This contrasts with an increase from just 8 to 11 students of 100 among entrants who never attended a for-profit, the report said.

But the most notable finding from the report is the stunning racial divergence in default rates, with black students a clear outlier, and expected to default at nearly double the rate as all other students, and 5 times as much as white college graduates.

The new data underscore that default rates depend more on student and institutional factors than on average levels of debt. For example, only 4 percent of white graduates who never attended a for-profit defaulted within 12 years of entry, compared to 67 percent of black dropouts who ever attended a for-profit. And while average debt per student has risen over time, defaults are highest among those who borrow relatively small amounts.

According to the author’s conclusion, “the results suggest that diffuse concern with rising levels of average debt is misplaced. Rather, the results provide support for robust efforts to regulate the for-profit sector, to improve degree attainment and promote income-contingent loan repayment options for all students, and to more fully address the particular challenges faced by college students of color.”

Whether that happens is debatable, however what is clear is that the coming default avalanche concentrated among former black students, one which will necessitate another broad taxpayer-funded bailout, the debt-busting taste of which we got this past July, will soon emerge as the root cause for the next racial crisis to sweep America, a nation which already finds itself on the edge of extreme polarization when it comes to race, ethnicity, political ideology and, of course, income.

Source Article from http://feedproxy.google.com/~r/blacklistednews/hKxa/~3/La5DiAdSJFk/M.html

Related posts:

Views: 0

RSS Feed

RSS Feed

January 15th, 2018

January 15th, 2018  Awake Goy

Awake Goy

Posted in

Posted in  Tags:

Tags: