Facebook CEO Mark Zuckerberg was caught quietly selling off over 1.14 million shares just days before the Cambridge Analytica scandal broke.

Two weeks before Facebook’s share price tumbled, Zuckerberg engaged in a bit of insider selling, according to Argus Research’s Vickers Weekly Insider.

Orrazz.com reports: In the Facebook case, Zuckerberg and another executive sold shares about $20 above where they were trading Tuesday.

Analysts are not suggesting anything nefarious behind the regularly scheduled sales. However, the sheer volume of the selling can amount to an overhang on the stock at a time when it could use all the support it can get.

Facebook shares dropped 6.77 percent into correction territory Monday, the first trading day after a data scandal involving 50 million accounts added to concerns about user privacy. Facebook shares traded 5.3 percent lower near $163 Tuesday afternoon.

“The insiders use Rule 10b5-1 to sell on a regular basis. There are trading plans that they adopt and then they sell shares in a methodological manner,” said Ben Silverman, director of research at InsiderScore. “I don’t see a connection between the insider selling and the news that has come out in the last few days.”

Still, investors and analysts who make buying and selling decisions based on executive stock moves give these plans some weight despite the benign status companies try to assign them.

“They can cancel the plans any time they want,” Silverman said. “Obviously [it’s] something we’ll look for in the wake of what’s going on and see if there’s any decrease in the insider selling volume in the near term.”

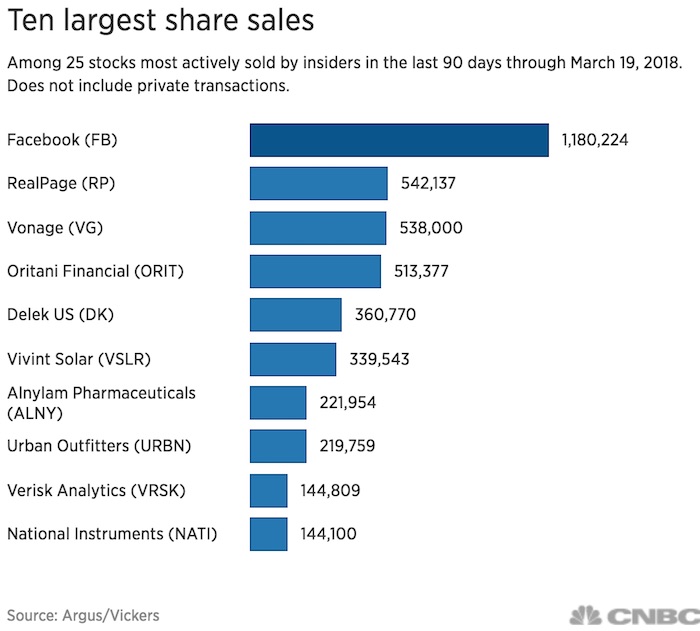

Companies often compensate executives with stock, which they can sell at their discretion or according to a scheduled plan as determined by the Securities and Exchange Commission’s Rule 10b5-1. After Facebook, the highest volume of insider selling during the last three months was at RealPage, Oritani Financial and Vonage, each selling more than half a million insider shares, according to the Vickers data.

Zuckerberg’s sales accounted for the most, by far. He announced plans in September to sell 35 million to 75 million shares over the next 18 months to fund philanthropic efforts. He and his wife, Priscilla Chan, have promised to give away 99 percent of their company stake to the Chan Zuckerberg Initiative, which has focused on disease and education.

In the last two weeks, Zuckerberg sold 228,400 shares a day on March 8 and March 9, 220,000 shares a day on March 12 and March 13, and 245,400 shares on March 14, the Vickers data showed.

That’s a total of just over 1.14 million shares sold at an average price of $183.81, for a payout of nearly $210 million. As of Wednesday, Zuckerberg still held nearly 393.1 million shares, or 13.53 percent of common shares outstanding, according to S&P Global Market Intelligence.

However, he has seen his wealth drop to around $66 billion from $75 billion since the stock closed on Friday, according to the Bloomberg Billionaire’s Index and Forbes.

The Vickers data also showed that Facebook’s Chief Technology Officer Michael Todd Schroepfer sold 38,024 shares on March 13. At the average price of $183.20, the stock sale brought in about $6,970,000.

Schroepfer has been selling every second week of the month since November 2016, said InsiderScore’s Silverman. “He’s probably selling under a plan that was adopted quite a while ago.”

Facebook declined to comment about the scheduled insider selling and the share-price decline.

Source Article from http://yournewswire.com/mark-zuckerberg-sells-facebook-stock/

Related posts:

Views: 0

RSS Feed

RSS Feed

March 22nd, 2018

March 22nd, 2018  Awake Goy

Awake Goy

Posted in

Posted in  Tags:

Tags: