As the economy starts to fully open, there are some glaring issues that are being exposed. First, there is still a deep crisis in housing on the affordability front. The Fed in partnership with big banks buying up properties, is causing major market disruptions that are pushing out regular first-time home buyers (aka younger Americans). Then you add the massive juicing of student loan debt where college costs have skyrocketed so many young Americans already have a mountain of debt before their first job. So, it is no surprise then, that half of young adults are living at home. And then you have many Americans deciding to opt for other work or quitting given the low wage economy that has created a near permanent underclass in this country. But wait, isn’t the stock market near a record high and real estate as well? First, half of Americans do not own one single stock. Second, as we just mentioned, those benefitting by higher home prices are largely baby boomers and hedge funds that are buying up properties to rent out to the new serfdom class of America, younger workers.

Half of Young Adults Living at Home

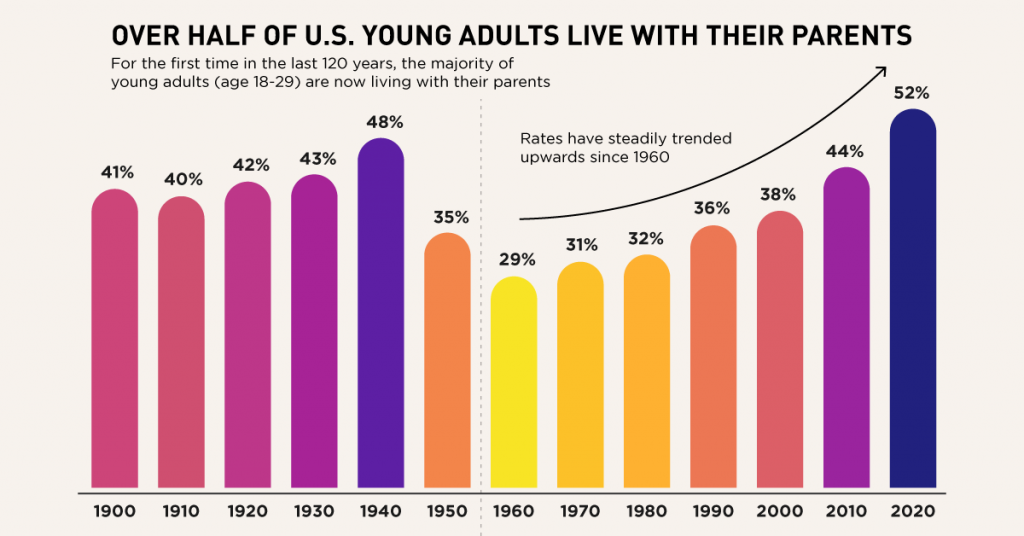

The percentage of young adults living at home today is even higher than it was during the Great Depression:

This has large down stream impacts. For example, household formation is a big deal in economics because when someone “starts a household” they usually buy big ticket items (refrigerators, couches, beds, televisions, etc.). So when you stunt this part of the economy, the implications are large in many areas.

You also have the issue of restricting the natural flow of the market. Right now, the market is juiced on easy money – and this easy money comes in the form of low interest rates. Wall Street is loving this and some of the unintended consequences are hedge funds buying up tons of properties across the country trying to chase yield. This blocks out first-time home buyers. Then you have baby boomers refinancing their homes and essentially jacking up their portfolios, but many were already in a comfortable position. The end result is young Americans cannot compete since they have yet to accumulate any significant amount of wealth and the juicing apparatus is set to reward those who already had these asset classes.

It is also causing some interesting family dynamics. In expensive metro areas, children are now simply quietly waiting for their parents to die so they can finally “own” a home. When they look at their balance sheet, that is the only way they are going to enter the real estate market as an owner. Parents try to blame avocado toast and Starbucks but the reality is, the two-income trap is a very real thing and many of these people bought a home with one income and a blue collar job – something that is virtually impossible today in many markets.

So it probably is no surprise that Crypto and Robinhood are extremely popular since people do not want to dollar cost average for 30-years for a nice nest egg and would rather swing for the fences in the hope they can pull themselves out of the Gen Z and Millennial wealth trap.

Now what is wrong with living at home? Nothing really. But when you look at the data most are not opting to live at home. It is done because rents and buying a home are out of reach. Simply looking at the stock market and real estate prices does not signal a healthy economy. We have some serious issues ahead, including inflation cutting into purchasing power. For the moment we will continue to see half of young Americans living at home.

Related posts:

Views: 0

RSS Feed

RSS Feed

June 27th, 2021

June 27th, 2021  Awake Goy

Awake Goy  Posted in

Posted in  Tags:

Tags: