Last week, Goldman Sachs pointed out a very disturbing trend in the US labor market: where the participation rate for women in the prime age group of 25-54 have seen a dramatic rebound in the past 2 years, such a move has been completeloy missing when it comes to their peer male workers. As Goldman’s jan Hatzius put in in “A Divided Labor Market”, “some of the workers who gave up and dropped out of the labor force during the recession and its aftermath still have not found their way back in.” In fact, the labor force participation rate of prime-age (25-54 year-old) women has rebounded quite a bit and is now only moderately below pre-crisis levels, but the rate for prime-age men remains well below pre-crisis levels.

While Goldman did not delve too deeply into the reasons behind this dramatic gender gap, BofA’s chief economist Michelle Meyer did just that in a note released on Friday titled “The tale of the lost male.” As we have discussed previously, and as Goldman showed recently, Meyer finds that indeed prime-working age men – particularly young men – have failed to return to the labor force in contrast to women who have reentered. According to Meyer, while this reflects some cyclical dynamics, including skill mismatch and stagnant wages, what is more troubling is that there are several new secular stories at play such as greater drug abuse, incarceration rates and the happiness derived from staying home playing games.

The macro implications, while self-explanatory, are dire: with the labor force participation rate among young men unlikely to rebound, the unemployment rate should fall further and cries of labor shortages will remain loud, even as millions of male Americans enter middle age without a job, with one or more drug addition habits, and with phenomenal Call of Duty reflexes. Here’s why.

First the facts

The overall LFPR is at 62.7%, up from the lows of 62.4% in 2015 but still considerably below the peak in 2000 of 67.3%. BofA estimates that more than half of the decline in the LFPR is due to demographics – as the population ages, the aggregate participation rate naturally falls. However, even after controlling for demographics, the participation rate of prime-working age individuals has failed to recover. As shown by Goldman above, and in BofA’s Chart 1 below, “this reflects the fact that men have not returned to the labor force. This is not a new phenomenon as the participation rate for prime working aged men has been on a secular downshift for the past several decades. However, it stands in contrast with the participation rate of women of the same age cohort which has rebounded nicely.”

Looking at age cohorts, the weakness among men is particularly acute among 25-34 years old where the rate has continued to slip lower. This is offset by a modest uptrend in participation among men aged 45-54 years old (Chart 2). In other words, the millennial men have remained on the sidelines of the labor market.

Now the theories

Why haven’t men – particularly millennial men – returned to the labor market? According to Meyer, on the one hand, there are the typical business cycle explanations which center on the mismatch in skills. There is also the theory of stagnant wages which may discourage new entrants into the labor market. On the other hand, there are secular changes for men, including the rise in pain medication usage (opioid drug abuse), incarcerations, and prioritization of leisure (think video games).

BofA reviews each in order, starting with the story of mismatch

The recession resulted in more severe job cuts for men than for women, in part due to the nature of the downturn; indeed, male employment fell by a cumulative 6.9% vs a 3.2% drop for women. The goods-side of the economy shed workers, particularly in construction and manufacturing, which tend to be more male-dominated. Both sectors were slow to recover, leaving workers to become detached from the labor market with depreciating skills. Moreover, the destruction of jobs in these sectors discouraged the younger generation from attaining the skills necessary to enter these fields. A prime example is the construction sector: the average age of a construction worker increased to 42.7 in 2016 from 40.4 pre-crisis, reflecting the fact that there were fewer young workers becoming trained in the discipline. By mid-2013, builders started to complain about the difficulty in finding labor, particularly skilled workers. This illustrates how the Great Recession displaced workers and led to a mismatch of skills.

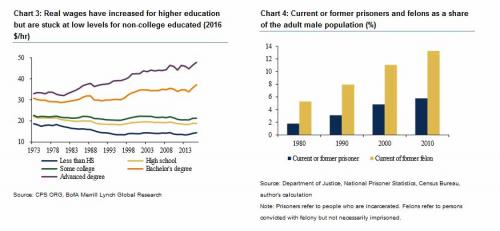

Logically, there is also the influence of rising wages – or the lack thereof – on the incentive to work. Wage growth has been slow to recover on aggregate with only 2.4% yoy nominal wage growth as of October. However, there are differences by education with relative weakness for less educated men (Chart 3). This shows the demand shift away from this population, leaving them on the fringe of the labor force. Accordingly, the labor force participation rate for men with only a high school diploma has declined by 6.2% since 2007 vs. the 5.3% drop in the college educated cohort.

The pain from opioids

Moving to the more depressing narratives, BofA next explores the possibility that the rise in drug abuse – particularly opioids – is leaving men unemployed and displaced from the labor force. Recent work from Alan Krueger found that the rise in opioid prescriptions from 1999 to 2015 could account for about 20% of the decline in the male labor force participation rate during that same period. Referencing the 2013 American Time Use Survey – Well-being Supplement (ATUS-WB), 43% of NLF prime age men indicated having fair or poor health, a stark contrast with just 12% for employed men. The same cohort also reported significantly higher levels of pain rating, with 44% having taken pain medication, opioids particularly, on the reference day. It is hard to prove causality – is the increase in pain causing more dependence on opioids, leading to a drop in the labor force participation, or did the lack of job opportunities lead this population to drug abuse? Either way, it seems to be a factor keeping prime aged individuals from working – both men and women, according to Kreuger’s analysis.

Incarceration on the rise

The rising number of incarcerations imposes another issue. Although prisoners are not counted toward the total civilian non-institutional population when calculating the LFPR, the problem associated with the labor market goes beyond prisons. The growing number of incarcerations has left more people with criminal records, making it difficult for them to reenter the workplace. Indeed, the share of male adult population of former prisoners has increased from 1.8% in 1980 to 5.8% in 2010 (Chart 4). The Center for Economic and Policy Research has also found that people who have been imprisoned are 30% less likely to find a job than their non-incarcerated counterparts. Not surprisingly, a look into the details by demographic cohort finds that men make up nearly 93% of all prisoners, of which one third are between the ages of 25 and 34.

Why work when you can play video games

Finally there is the question of preference – is it possible that we are seeing more young men choosing leisure over labor? According to the ATUS (time use survey), between 2004-07 and 2012-15, the average amount of time men aged 21-30 worked declined by 3.13 hours while the number of hours playing games increased by 1.67 and the hours using computers rose by 0.6 (Chart 5). Once again there is a question of causality – are young men playing video games because it is hard to find work or because they prefer it over working? Using the 2013 Supplement ATUS, Krueger finds that game playing is associated with greater happiness, less sadness and less fatigue than TV watching and it is considered to be a social activity. This can create a loose argument that the improvement in video games has increased the enjoyment young men get from leisure, putting a priority on leisure over labor. It also begs the question over whether welfare benefits for the unemployed aren’t just a touch too generous, but that is a discussion best left for another day…

Whatever the reasons behind the collapse in male – and especially Millennial – labor force participation, the undeniable result has led a number of industries to report persistent labor shortages. To get a sense of this, BofA compares the ratio of the rate of job openings to hires across major industry using the JOLTS data. All major sectors have witnessed an increase in the ratio (Chart 6). (Note that due to trend differences across industries, it is more important to look at the relative changes in ratios instead of their absolute values). The biggest relative increase was in construction followed by transportation and utilities. This is the goods side of the economy where men tend to be a larger share of the working population, therefore highlighting the challenges in the economy from the shortage of men participating in the labor force. This is consistent with Beige Book commentary which highlighted in the latest edition that “Many Districts noted that employers were having difficulty finding qualified workers, particularly in construction, transportation, skilled manufacturing, and some health care and service positions.”

There are two implications: number one, the unemployment rate is set to fall further. In October we already touched 4.1% and are just a few thousand workers away from a 3-handle on the unemployment rate. The second is that wages should be rising. As Meyer writes, while it has yet to translate to a decisive higher trend in wage inflation, “we continue to argue that further tightening in the labor market will gradually succeed in generating faster wage growth.” To be sure, modest upward pressure on wages – especially if it is felt across industries and education levels – could encourage some return of labor, but it will likely be slow given the structural challenges addressed above. The consequence: cries of labor shortages will remain loud, even as wages finally rebound from chornically, and troublingly, low levels. In fact, some speculate that the wage rebound – once it emerges – could be sharp and destabilizing, and ultimately, as Albert Edwards predicted, could result in a “nightmare scenario” for the Fed (and capital markets) which will suddenly find itself far behind the tightening curve.

Source Article from http://feedproxy.google.com/~r/blacklistednews/hKxa/~3/mZ78qP641_c/M.html

Related posts:

Views: 0

RSS Feed

RSS Feed

November 13th, 2017

November 13th, 2017  Awake Goy

Awake Goy

Posted in

Posted in  Tags:

Tags: