In December alone, consumer prices soared by a hyperinflation-like double-digits, rising 13.58%, the Turkish Statistical Institute said on Monday, eating deeper into the earnings and savings of Turks ravaged by Erdogan’s demented economic turmoil.

The surge in prices reflected a more front-loaded exchange rate pass-through than usual triggered by the size of the exchange rate depreciation. However, as Goldman Sachs notes, inflation in categories like services that are typically not as sensitive to the exchange rate rose sharply as well – reflecting the lack of anchoring of inflation expectations.

Core inflation also surprised to the upside rising to 31.9% yoy in December from 17.6% yoy in November (consensus 24.3% yoy). Given the upside surprise with mom inflation of 13.6% not seasonally adjusted, Goldman thinks that inflation will rise above 40% in Q1-22 and remain there for most of the year.

The explosion in prices is tied to the record drop in Turkey’s lira which lost 44% of its value last year as the central bank slashed interest rates under a drive by Erdogan to prioritize credit and exports over currency and price stability. On Monday it whipsawed down 5% then up 3%, before trading flat at 13.2 vs the dollar.

Some economists are predicting that inflation will reach as high as 50% by spring unless the direction of monetary policy is reversed, which as Erdogan has made very clear, it won’t be, and after the central bank is done blowing tens of billions of dollars it doesn’t have to keep the lira from cratering, we expect total currency and economic collapse.

“Rates should be immediately and aggressively hiked because this is urgent,” said Ozlem Derici Sengul, founding partner at Spinn Consulting in Istanbul. Ozmel will probably be arrested in the next 24-48 hours for pointing out the obvious.

The central bank was however unlikely to act, she added, and annual inflation “will probably reach 40-50% by March”, by when administered price rises would have been added into the mix, including a 50% minimum wage hike.

While last year was the worst for the lira in nearly two decades, while the annual CPI was the highest since the 37.0% reading of September of 2002, two months before Erdogan’s AK Party first took office.

But Erdogan’s focus on Monday was on trade data which showed exports surged by a third to $225 billion last year.

“We have only one concern: exports, exports and exports,” he said in a speech, adding the trade data showed a sixth-fold rise in exports during his tenure as leader. What Erdogan didn’t focus on is that while exports for all of 2021 rose, in December the country’s trade deficit exploded by 46%, widening to $6.64BN, as imports rose 29% to $28.9BN, far more than exports which rose just 25% to $22.3BN.

In other words, even Erdogan’s focus on exporting his way out of the current crisis is starting to fail.

Erdogan, a self-declared enemy of interest rates, overhauled the central bank’s leadership last year, by which we mean he fired any central bank direct who disagreed with him.

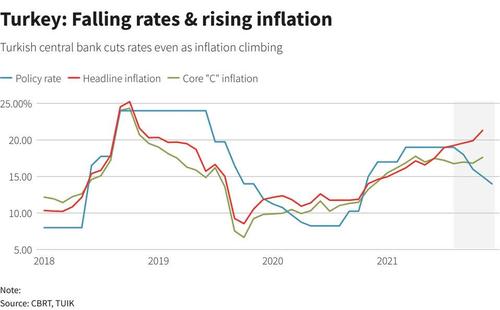

The bank has slashed the policy rate to 14% from 19% since September, leaving Turkey with deeply negative real yields that have spooked savers and investors. The subsequent accelerating surge in prices and drop in the lira have also upended household and company budgets, scuttled travel plans and left many Turks scrambling to cut costs. Many queued last month for subsidized bread in Istanbul, where the municipality says the cost of living is up 50% in a year.

“We don’t sit with our friends in a cafe and drink coffee any more,” Mehmet, 26, a university graduate, said as he did his job as a pollster in Istanbul.

“We don’t go out, just from home to work and back again,” he said, adding he was buying smaller meal portions and believed inflation was higher than official data showed. In other words, just like in the US.

And just like in the US, the Turkish central bank has idiotically argued that “temporary” factors had been driving prices and forecast a volatile course for inflation, which – having been around 20% in recent months and mostly double-digits over the last five years – it said in October would end the year at 18.4%. Oops.

Sengul said that, with Monday’s data, that argument was over: “This reflects a vicious cycle of demand-pull inflation, which is very dangerous because the central bank had implied the price pressure was from cost-push (supply constraints), and that it couldn’t do anything about it,” she said.

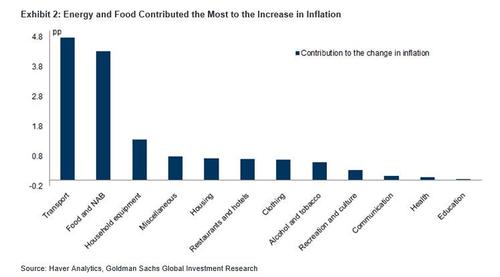

Reflecting soaring import prices, December’s producer price index rose 19.08% month-on-month and 79.89% year on year. Annual transportation prices soared 53.66% while the food and drinks basket jumped 43.8%, the CPI data showed.

The economic turmoil has also hit Erdogan’s opinion polls ahead of a tough election scheduled for no later than mid-2023. read more

The lira touched a record low of 18.4 against the dollar in December before rebounding sharply two weeks ago after state-backed market interventions, and after Erdogan announced a scheme to protect lira deposits against currency volatility.

What does all of this mean for the worst performing currency of 2021? Well, at first, the Turkish lira weakened sharply as the market did the only logical thing it can do when hyperinflation sets in – it sold the currency, and in early trading, the lira depreciated as much as 4.5% per U.S. dollar on its first trading day in the new year, extending its losing streak to a sixth day, having given up more than 30% of the gains made after President Recep Tayyip Erdogan unveiled a plan on Dec. 20 to bolster the lira by shielding savings held in local currency.

However, shortly after the central bank stepped in with yet another ridiculous intervention that cost it about $1 billion (at this rate the central bank will be out of all intervention funding in a few weeks), and the lira reversed losses of as much as 4.5% to gains as much as 3.6%.

Unfortunately for Erdogan, such day-to-day attempts to crush the shorts will only work for a few days, and as Goldman wrote today, the bank continues to believe that the current interest rate policy with rates of 14% supported by administrative and quasi fiscal measures will not succeed in stabilizing the TRY sustainably. And while Goldman’s forecast is for rates to rise sharply in Q2-22 the bank’s Turkish strategist admitted that his “confidence is not high in this call” given that the authorities continue to prefer non-standard policy choices to attempt to stabilize the TRY. As a result, the most likely outcome is that the currency will soon retest – and breach – its all time lows as the Turkish economy sinks into the hyperinflationary mire.

Related posts:

Views: 0

RSS Feed

RSS Feed

January 3rd, 2022

January 3rd, 2022  Awake Goy

Awake Goy

Posted in

Posted in  Tags:

Tags: