After over a decade of the much-hyped U.S. fracking miracle, the U.S. oil and gas industry is having to deal with years of losses and falling asset values which has dealt the industry a serious financial blow. This is despite the fracking revolution delivering record oil and gas production for the past decade, peaking in 2019.

While the pandemic has hurt the industry, companies have also benefited from excessive bailouts from pandemic relief programs but these bailouts are a stop gap financial band-aid for the struggling industry.

The oil and gas industry has always required huge amounts of money to explore for and produce oil and gas but up until now the industry made returns on those investments

The industry made a huge bet on fracking shale deposits to unleash the oil and gas reserves in that shale. It worked from a production standpoint; the industry produced record amounts of oil and gas. The difference is that, unlike traditional oil and gas production, the cost to produce fracked oil and gas was more than what the market was willing to pay for it.

As a result, the U.S. fracking industry has lost over $300 billion. Fracking was supposed to be the future of the U.S. oil and gas industry — instead it has dealt the industry a major financial blow which has likely sped up the energy transition away from oil and gas towards a lower carbon future.

The losses are staggering

In April 2018, while many were predicting a bright financial future for the U.S. fracking industry, DeSmog started a series on the finances of the fracking industry with the article, The Secret of the Great American Fracking Bubble. This article highlighted the huge losses by the U.S. fracking industry, which were around a quarter trillion dollars at the time.

More than two years later the Washington Post ran an article on “Shale’s Bust” and updated the losses to-date to be $300 billion — noting that while the pandemic made things worse, “the sector’s weaknesses extend back many years.”

In late 2019, before the pandemic hit, Chevron wrote off $11 billion, the majority of which was related to gas fracking assets. This trend continued in the industry in 2020 with historic write-downs of the industry’s remaining fracking assets, and in June, accounting firm Deloitte estimated the industry could soon write off $300 billion more.

This is what the fracking revolution has done to the U.S. oil and gas industry: financial devastation.

Deloitte released an analysis of the industry finances in mid-2020 and Deloitte Vice President Duane Dickson told CNBC that “a wave of impairments may prompt the deepest consolidation the industry has ever seen over the next six to 12 months.” (Impairments are another way to refer to write-downs of asset values that must be reported as losses by the company.)

This historic contraction of the U.S. oil and gas industry is directly linked to the fracking revolution and the damage is likely to be permanent — and the companies that survive this round of bankruptcies will be saddled with huge debts, making it even harder to build future growth or positive cash flow.

Exxon’s struggles

The financial hit the fracking industry has taken from over a decade of poor investments is taking a particular toll on one major company: ExxonMobil. In 2009, the company held the title as the largest gas producer in the U.S. It used to be America’s most valuable company. But in August, Exxon was dropped from the Dow Industrial Average. And in December the oil giant made a list of America’s “Zombie” companies — companies that are borrowing more money than they make.

It started a decade ago, when Exxon was producing natural gas but wanted to get into the shale gas boom driven by fracking. This idea led to Exxon’s $41 billion acquisition of XTO, a shale gas fracking company. With the acquisition, Exxon bet big on the future financial potential of the U.S. shale gas industry. A bet that turned out to be one of the worst investments in the history of the U.S. oil and gas industry.

“[W]hat they did not foresee was that the success of fracking ultimately would lead to an oversupply that made the purchase price [for XTO] seem high looking backward,” Phil Flynn, Price Futures Group analyst, explained to S&P Global in 2019.

The success of fracking at producing large amounts of oil and gas is also what drove down prices for oil and gas. Fracking didn’t make money when oil and gas was at much higher prices but once prices dropped, the losses accelerated.

“If you’d said four years ago, ‘I’ve got a great investment idea for you — take half your money, burn it, take the other half of your money and put it under a mattress’… it would have been a terrible idea, a terrible investment strategy — except that it would have done better than the U.S. oil & gas industry has done over the last four years,” Clark Williams-Derry, analyst for the Institute for Energy Economics and Financial Analysis (IEEFA), explained at an energy conference in late 2020.

Exxon’s acquisition of XTO is a prime example of how the oil and gas industry’s drive for ever-greater profits blinded it to the reality of the finances of fracking.

But Exxon’s example also illustrates how fracking has been great at two things.

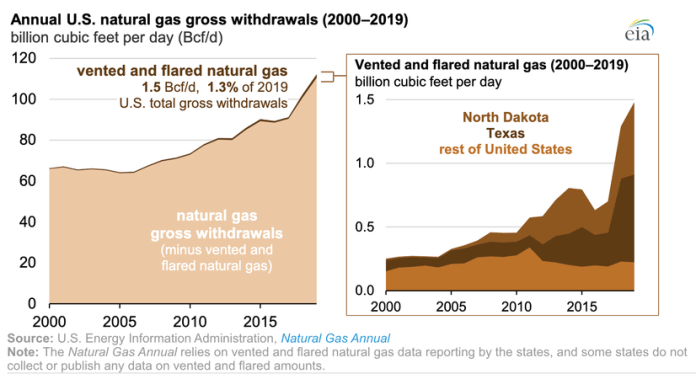

The first is unlocking huge amounts of natural gas and oil from shale deposits. And those oil wells also produce a lot of gas (known as associated gas), even though the oil companies don’t want it. This lack of value for associated gas has led to producers simply burning it (flaring) or venting it into the atmosphere.

Too much fracked gas pushed gas prices down. In mid-2019 prices for U.S. natural gas in Texas went below zero because more gas was being produced than could be sold. To address this market imbalance the oil producers would have to stop drilling more oil wells — that are responsible for the associated gas — something producers are unwilling to do.

The second thing fracking has proven to be great at is destroying investor capital. The industry has lost over $300 billion dollars in the past decade.

In November, Exxon announced it would write down $20 billion of its XTO investment. And there is likely more to come as early estimates were that the write-down would be for $30 billion. Some financial analysts have even accused Exxon of fraud for failing to accurately write down the XTO assets. When companies fail to accurately write down the value of assets, it can mislead investors to the true financial risks the company faces in the future, which can be a form of financial fraud.

Rex Tillerson, CEO of Exxon when it acquired XTO, commented on that deal last year saying, “We probably paid too much.”

But the same thing could be said for the majority of money invested in fracking in the U.S. Even investment legend Warren Buffett got lured into investing $10 billion in Occidental’s 2019 acquisition of Permian producer Anadarko — a deal on the scale of Exxon’s takeover of XTO and perhaps equally, if not more, financially devastating.

Overpayment for fracking assets in the U.S. has financially crippled the U.S. oil and gas industry. In August, Exxon announced it was stopping contributions to its employee compensation plan. In October, Exxon announced it was cutting 15 percent of its global workforce. At the same time, Exxon borrowed another $23 billion in 2020.

And it’s not just Exxon that has taken a hit. A decade ago, Chesapeake Energy was the second largest gas producer in the U.S. behind Exxon. Chesapeake existed because of the success of fracking for methane (natural gas) in the U.S.; the company’s CEO, Aubrey McClendon, was paid $100 million in 2009.

But now, in 2020, Chesapeake Energy’s title of “shale pioneer” is making headlines due to the company’s bankruptcy.

While Exxon and Chesapeake Energy are some of the larger examples of companies to succumb to the fracking revolution’s over-hype, the industry is in the midst of a rash of bankruptcies, and the long-term damage to the industry is far from over.

Pinning hopes to LNG

Many of the big problems facing the fracking industry can be linked to gas as opposed to the record oil production that resulted from the fracking boom.

The industry was right about fracking’s potential to produce natural gas. And Wall Street was happy to loan the money to make it happen. Meanwhile, many executives got rich in the process.

When Exxon bought XTO it bet big on higher future natural gas prices. But Exxon produced too much gas — along with the rest of the fracking industry doing the same. This resulted in gas prices going down. This surge in gas production essentially sabotaged the industry’s own bet on gas prices.

The record production drove down global gas prices to below $2 per million British Thermal Units (MMBtu). Yet, analysts believe the U.S. industry needs minimum prices of $2.50 per MMbtu to break even. November 2020 is the only month where prices were above $2.50/MMBtu in 2020 with prices reaching a low of $1.63 MMbtu in June.

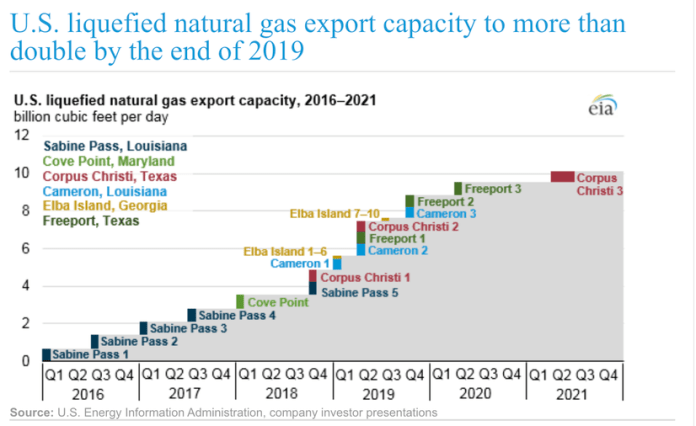

To try and make up for this over-production problem, a few years ago the oil and gas industry came up with a plan. It would take all the excess natural gas and liquefy it and sell that liquefied natural gas (LNG) to the world. This unleashed a huge wave of investment in LNG export terminals with capacity starting to increase rapidly in 2016.

But just as happened with the U.S. gas market, the global market was also awash in natural gas and LNG. In January 2020, Bloomberg published the article “Global LNG Poised for Terrible Year as Supply Floods Market” which highlighted the problem.

Prices plummeted in 2020 and investments in American LNG have virtually disappeared in 2020.

Prices for LNG have,however, rebounded in late 2020 due to recent production decreases from major global suppliers like Qatar and Australia as a result of unplanned maintenance and bad weather shutting down exports from Algeria. In response, the U.S. is exporting record amounts to meet this demand, but as prices have risen, some countries have stopped buying.

This current supply shortage is likely a temporary situation due to short-term dynamics but illustrates the price sensitivity facing the natural gas industry. When prices rise too much, there are cheaper alternatives to LNG.

Competition from renewables

At the same time, cheap renewable energy is out-competing gas.

A new report released in December by industry analysts Wood MacKenzie predicts that “More than 75% of new liquefied natural gas global supply could be at risk due to competition from renewable energy.”

In December, the Energy Information Administration (EIA) predicted that the share of electricity in the U.S. produced by natural gas would decline “in response to a forecast increase in the price of natural gas delivered to electricity generators.” The EIA predicts that the percentage of U.S. power generated from natural gas could fall from 39 percent in 2020 to 34 percent in 2021 due to a rise in prices. And the EIA predicts renewable energy, and a return to coal in some locations, will replace that market share.

This highlights a fundamental problem facing the gas industry. Current prices are too low for the industry to make money. But when prices rise to levels where the industry could make money, the gas is no longer economically competitive because renewable energy is cheaper right now.

As gas prices rise and renewable energy prices continue to fall, the U.S. gas industry is in a no-win situation.

A recent analysis by the Institute for Energy Economics and Financial Analysis (IEEFA), for instance, found that shale gas producers in the Appalachian region of the U.S. lost another $500 million in the third quarter of 2020.

The U.S. gas industry also is suffering due to the warmer winters the U.S. is experiencing — warmer weather due in part to the burning of fossil fuels and the methane released by the natural gas industry. Warmer weather depresses gas prices because there is less heating demand.

IEEFA, which has been tracking the industry’s decline, recently summed up the reality of what the “shale revolution” has done: “The shale revolution has turned the U.S. into the world’s most prolific gas producer. Yet in financial terms, the gas production boom has been an unmitigated financial bust.”

It’s Not Easy to Pay Off Debt

Despite all of this, to this day, the U.S. oil and gas industry is still producing large amounts of oil and gas by fracking — and it continues to lose money doing it. The companies that are doing this have taken on large amounts of debt to make this happen.

Continental Resources CEO and majority owner Harold Hamm has been one of the most visible proponents of fracking, even inheriting the title of “Shale King” from the previous king of fracking, Aubrey McClendon.

Continental has been the leading producer in North Dakota’s Bakken shale play, and in 2017, Hamm declared that Continental’s policy was “Absolutely no new debt.”

But in the second quarter of 2020, investment site Seeking Alpha noted Continental’s debt increased from $5.3 billion to $6 billion, noting that this debt was “unsustainable.” Simply Wall Street, another investing site, concluded in October that “it looks like Continental Resources has too much debt.”

For the last five years Whiting Petroleum has consistently been one of the top producers of oil in the Bakken behind Continental, yet it declared bankruptcy in 2020 because it couldn’t pay off its debt.

Paying off debt is also made more difficult when there are fewer and fewer strong producing sites. As DeSmog has detailed, in the past decade the fracking industry drilled and fracked most of the best oil producing acreage.

And right now the industry is only producing from its highest producing areas — an approach known as high grading. But in the Bakken there aren’t many of the best wells left (and the trend is that wells are becoming less productive across the various shale plays in the U.S., including the Bakken).

Effectively, with less promising sites, less oil and gas is extracted and fewer profits can be made to pay off corporate debt.

In the case of Continental, once its high grading options run out, there is only one way for the industry to go, according to Seeking Alpha: “Beyond this year, it [Continental] will most likely see a continued trend of well performance deterioration, which will not be a welcome trend given the added pressure of more debt that is now accumulating and will have to be serviced.”

Bold promises

Throughout all of this, companies are making bolder promises while the losses and debt has continued to grow. The industry has consistently asked investors to be patient as profits, they said, were just on the horizon.

Despite claims by Parsley Energy’s CEO Matt Gallagher, or those from the likes of the now bankrupt Whiting Petroleum, that the fracking industry could make money when oil prices were as low as $40 a barrel, and Exxon even saying they could produce fracked oil in the Permian for $15 a barrel, this hasn’t happened.

In October, Lynn Helms, director of North Dakota’s Mineral Resources Department, has said that oil prices would have to be $55 a barrel for anyone to drill a new oil well in the Bakken. Oil prices have so far risen recently to nearly $50 a barrel, but with the pandemic still keeping the pressure on oil demand, it is unlikely that prices are headed much higher in the next year.

Many predictions expect low oil prices for several years with prices not returning to $55 a barrel until 2023 — which would very likely cause many more shale company bankruptcies.

No Money to Clean Up Environmental Damage

All of this comes at the cost of our environment.

The industry was unleashed on the U.S. without proper regulations. This has resulted in it greatly contributing to methane emissions — and further methane regulations were rolled back in 2020by the Trump administration. At the same time, new regulations proposed at the state level in New Mexico have major loopholes that exempt the majority of wells in the state and thus are ineffective.

The industry has also vented and flared huge amounts of natural gas, further contributing to climate change and air pollution. Flaring the natural gas creates the greenhouse gas carbon dioxide while venting the natural gas (methane) to the atmosphere without burning it is even worse as methane’s climate impacts can be 85 times that of carbon dioxide over a 20 year period.

The industry also produces radioactive waste which, due to the lack of regulations, has led to improper disposal of the waste, causing widespread contamination in North Dakota and Pennsylvania. However, regulators decided in 1998that doing so would have “a severe economic impact on the industry and on oil and gas production in the U.S.” — so rules to properly address the waste issue have not been adopted.

And beyond all of that damage, the U.S. oil and gas industry is facing a bill of another quarter trillion dollars for the cleanup of old oil and gas wells. This cost is being passed on to the public as states and local municipalities are footing the bill for cleanup, rather than being paid for by the industry.

No light at the end of the tunnel

The U.S. fracking revolution hasenjoyed a spectacular run. President Barack Obama rightfully wanted credit for it and President Donald Trump also tried to claim it as his success. Neither publicly acknowledge that it was a financial and environmental disaster.

Fracking’s legacy will be that it made fracking company executives very wealthy as they lost hundreds of billions of investor money while poisoning the climate and environment and leaving the cleanup bill for the American public.

This December, the Wall Street Journal published an article that opened with the following question, “Does investing in oil and gas companies still make sense?”

For many reasons outlined by the Wall Street Journal, the answer to that question for more and more investors is “no.” And that is thanks in large part to the fracking revolution. The oil and gas business has always been cyclical but no one ever questioned its future viability until fracking unleashed ten years of financial devastation on the industry right as the renewable energy industry became a true competitor.

Related posts:

Views: 0

RSS Feed

RSS Feed

December 24th, 2020

December 24th, 2020  Awake Goy

Awake Goy

Posted in

Posted in  Tags:

Tags: