Who do billionaires turn to when they want to buy apartment complexes? The U.S. taxpayer.

Barry Sternlicht’s Starwood Capital Group and Stephen Schwarzman’s Blackstone Group LP are in talks with Freddie Mac to finance two transactions totaling more than $10 billion, according to people with knowledge of the negotiations. Those discussions come after the government-owned mortgage giant already agreed to back Lone Star Funds’ $7.6 billion deal to buyHome Properties Inc. and Brookfield Asset Management Inc.’s $2.5 billion takeover of Associated Estates Realty Corp.

“They wield a very big stick,” said John Levy, a principal at a real estate investment banking firm in Richmond, Virginia, that bears his name. “It takes more time and it’s going to be more expensive” to get transactions done without the two companies, which can lend at rock-bottom rates because their deals have implicit government backing.

Great! If anyone needs government backing, it’s America’s billionaires.

Buying apartment buildings in the U.S. has been a winning bet for the past several years as rents rise amid a shift away from homeownership. That’s attracting investors such as Starwood, which on Oct. 26 said it agreed to purchase 72 rental communities across the country from Equity Residential for $5.4 billion. The announcement came just days after Blackstone reached a $5.3 billion deal to buy Stuyvesant Town-Peter Cooper Village, Manhattan’s largest apartment complex.

Freddie Mac’s deals are getting bigger as its regulator expands the definition of affordable housing, enabling the company to make more loans. Properties that are deemed affordable by the Federal Housing Finance Agency are exempt from a $30 billion cap that limits how much the government-sponsored entities can lend to apartment landlords each year.

What Bloomberg fails to elaborate on is what expanding “the definition of affordable housing” often means in practice. A great example relates to the EB-5 program. From the post: More American Cronyism – U.S. Government Selling Visas to Fund Luxury Apartment Buildings.

The program through which that happens, known as EB-5, enables foreign nationals to obtain U.S. permanent-resident status by putting up money for new business ventures that create American jobs. It gives ventures in high-unemployment and rural areas a special status to encourage investment. But as the program’s popularity has soared in recent years, the bulk of immigrant investment is going to projects that are located, like $20 billion Hudson Yards, in prosperous urban neighborhoods.

At least 80% of EB-5 money is going to projects that wouldn’t qualify as being in Targeted Employment Areas without “some form of gerrymandering,” estimates Michael Gibson, managing director of USAdvisors.org, which evaluates projects for foreign investors.

Increasingly, the money appears to be flowing to the flashiest projects, which the investors often see as safest, EB-5 professionals say. Among those getting EB-5 money are an office building set to host Facebook Inc. near Amazon.com Inc.’s Seattle headquarters, a boutique hotel in high-end Miami Beach, and a slim Four Seasons condo-hotel in lower Manhattan that sports a penthouse with an asking price above $60 million. In all of them, geographic districts were crafted to include higher-unemployment areas.

I’d be shocked if similar shenanigans weren’t also happening when it comes to the Freddie Mac financed real estate transactions described in today’s piece.

Now, back to Bloomberg…

U.S. multifamily-building prices are 33 percent higher than they were at the prior peak in 2007, according to Moody’s Investors Service and Real Capital Analytics Inc., a jump stoked partly by the abundant financing from Fannie Mae and Freddie Mac. That’s raised concerns that a bubble is forming that might pop when interest rates rise, according to Levy, the investment banker. Taxpayers could be on the hook for losses incurred by the mortgage companies if apartment values were to fall sharply.

Socialism for the rich, Darwinian capitalism for the sucker taxpayer.

Meanwhile, it’s quite shocking that Freddie Mac is the key player behind all of this considering we learned last week that: FHFA Head Warns Fannie Mae and Freddie Mac May Need a Capital Injection from the U.S. Treasury.

At Freddie Mac, private investors would shoulder about the first 15 percent of losses on multifamily deals, providing a cushion in the event of a decline in building values, Brickman said.

It would be extremely unlikely that we would ever be called upon to support our guarantee,” he said. “We are sticking to our principles and underwriting prudently.”

Famous last words.

“If the purpose of the GSEs is to provide liquidity to the secondary mortgage market, in an effort to promote homeownership, a focus on funding multifamily rental properties seems inappropriate,” Josh Rosner, an analyst at research firm Graham Fisher & Co., said in an e-mail. “This approach only serves to deliver a public subsidy to private players.”

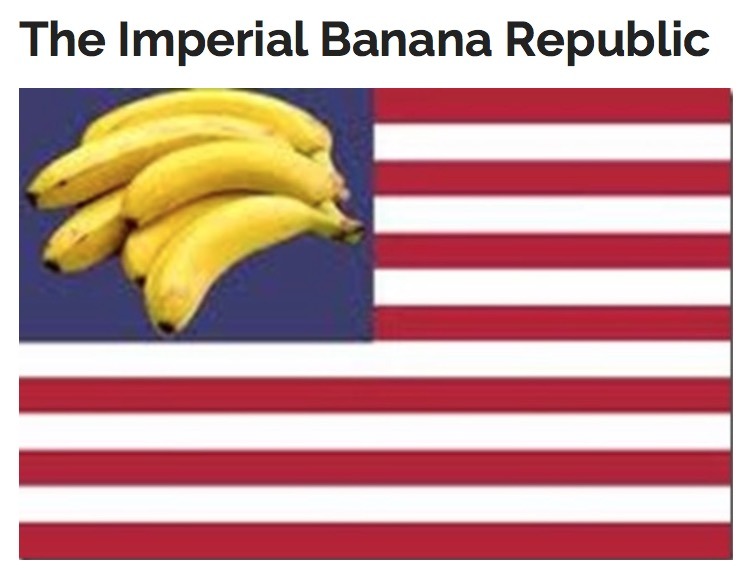

Just another day in

For related articles, see:

The Oligarch Recovery – U.S. Military Veterans are Selling Their Pensions in Order to Pay the Bills

The Oligarch Recovery – 30 Million Americans Have Tapped Retirement Savings Early in Last 12 Months

The Oligarch Recovery – Low Income Americans Can’t Afford to Live in Any Metro Area

The Oligarch Recovery – Renting in America is Most Expensive Ever (while the landlords get subsidized by the taxpayer).

In Liberty,

Michael Krieger

Source Article from http://feedproxy.google.com/~r/blacklistednews/hKxa/~3/CUHAHoLhuM4/M.html

Related posts:

Views: 0

RSS Feed

RSS Feed

November 10th, 2015

November 10th, 2015  Awake Goy

Awake Goy  Posted in

Posted in  Tags:

Tags: