Please see the preceding posts in our CalPERS Debunks Private Equity series:

• Executive Summary

* Investors Like CalPERS Rely on ILPA to Advance Their Cause, When It is Owned by Private Equity General Partners

* Harvard Professor Josh Lerner Gave Weak and Internally Contradictory Plug for Private Equity at CalPERS Workshop

* CalPERS Used Sleight of Hand, Accounting Tricks, to Make False “There is No Alternative” Claim for Private Equity

• How CalPERS Lies to Itself and Others to Justify Investing in Private Equity

* More on How CalPERS Lies to Itself and Others to Justify Investing in Private Equity

We’ve documented past instances of how the giant California pension fund CalPERS has operated as if can ignore the Bagley-Keene Open Meeting Act. That law is designed to assure that state official receive input from interested members of the public before making decisions. From Wikipedia:

The Bagley-Keene Act of 1967, officially known as the Bagley-Keene Open Meeting Act, implements a provision of the California Constitution which declares that “the meetings of public bodies and the writings of public officials and agencies shall be open to public scrutiny”, and explicitly mandates open meetings for California State agencies, boards, and commissions…

The act also reaffirms, “The people of this state do not yield their sovereignty to the agencies which serve them. The people, in delegating authority, do not give their public servants the right to decide what is good for the people to know and what is not good for them to know. The people insist on remaining informed so that they may retain control over the instruments they have created.”

We’ve already documented two long-standing violations of Bagley-Keene by CalPERS. One was in having the board approve bonuses and salary increases for CalPERS’ top executives in “closed session” which is California-speak for private meetings. CalPERS redid its 2014-2015 awards in “open session” after we alerted the board members of this flouting of the law.

While the compensation issue might be deemed to be mere sloppiness, more troubling is what appears to be systematic, flagrant violations of Bagley-Keene via CalPERS’ staff engaging in extensive pre-board meeting briefings of board members. We documented this abuse at length and concluded:

[Board member Michael] Bilbrey has laid bare an ugly truth: the board, save Jelincic, has accepted the idea that the public board meetings are frequently nothing more than pro-forma “show trials.” This governance theater allows CEO Anne Stausboll and her staff to control the organization’s levers of power. The result is an abject failure of adequate oversight and a conspiracy to deny the public the right to observe and provide input into policy decisions.

In the CalPERS’ private equity workshop last month, CalPERS was apparently desperate to make sure that the flattering, and as as we’ve described, often misleading story that its carefully-chosen experts told the board and greater public went off without any complicating or contradictory information. The perceived importance of keeping outside views at bay led the chairman of the Investment Committee and CalPERS’ General Counsel Matthew Jacobs to engage in not just one, but two violations of Bagley-Keene via:

¶ Denying the public the right to comment after each agenda item

¶ Impermissibly limiting the amount of time for each speaker

Denying the Public the Right to Comment After Each Agenda Item

California state law (see government code section 11125) sets for the requirements for the notification requirements for public meetings. Here are the germane sections:

(a) The state body shall provide notice of its meeting to any person who requests that notice in writing. Notice shall be given and also made available on the Internet at least 10 days in advance

of the meeting…

(b) The notice of a meeting of a body that is a state body shall include a specific agenda for the meeting, containing a brief description of the items of business to be transacted or discussed in

either open or closed session.

Thus, a “notice” on the Internet is required by law. That notice must put forward the agenda for the meeting.

Section 11125.7 sets forth the public’s right to comment on items on the agenda:

(a) Except as otherwise provided in this section, the state body shall provide an opportunity for members of the public to directly address the state body on each agenda item before or during the state body’s discussion or consideration of the item….

(d) The state body shall not prohibit public criticism of the policies, programs, or services of the state body, or of the acts or omissions of the state body. Nothing in this subdivision shall confer any privilege or protection for expression beyond that otherwise provided by law.

Yet as we will show, the sort of censorship that is proscribed in (d) is precisely what took place. And the only intent could have been to deny the board the opportunity to obtain information about private equity that conflicted with what the staff wanted the board to hear.

Here is the agenda for the CalPERS Investment Committee meeting on November 16, 2015. If you visit the page, you will see it repeatedly labeled as an agenda:

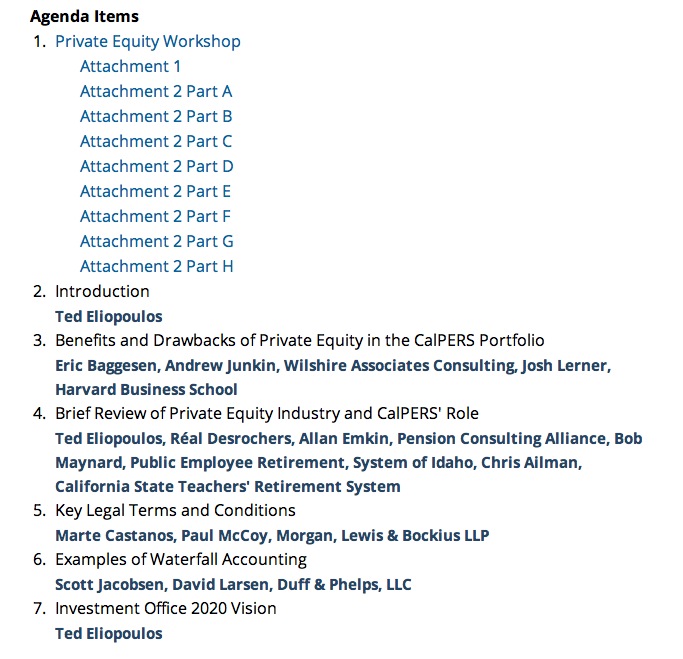

And if you scroll to the bottom of the page, you see the private equity workshop clearly listed as having its own agenda, broken into seven discrete items:

That means a single member of the public by law should have had the opportunity to speak after every one of the seven agenda items (the odd posting of the workshop materials as a separate agenda item could have served as an opportunity to comment on them before the second matter, the “introduction” by Ted Eliopoulos). I had intended to speak on four of the seven agenda items.

But look what happened when a member of the public, who later identified himself as Michael Flaherman, a former chairman of CalPERS investment committee and senior member of a private equity firm asked for the right to speak after agenda item 3. Note that Flaherman can barely be heard on the tape, but his remarks were clearly audible in the room at the time:

Michael Flaherman: Mr. Chairman, is it appropriate to take public comments?

Investment Committee Chairman Henry Jones: We will take public comments at the end of the workshop.

Flaherman: I don’t mean to belabor this point, but under the Bagley-Keene Act, you are required to take public comments after each agenda item.

Jones: Mr. Jacobs, would you comment on that, please?

General Counsel Matthew Jacobs: The agenda item we’re that talking about here is the general agenda item. It’s the whole agenda item.

Flaherman: [raises objections; he had a piece of paper in his hand which presumably contained the same agenda shown above; I recall him stating that the agenda showed multiple items]

Jones: [speaking over Flaherman]: Sir, sir, we’re not going to argue about this. Our counsel has said that we are right with this and we will take comments at the end of this agenda.

You can clearly see from the published agenda which was the one CalPERS was required to provide by law, that Jacobs’ remarks about “general agenda item” was flagrantly false. Moreover, if you were in the room at the time, it was clear there was no intention of dealing with the public’s right to comment in a good faith manner. Jones could not even be bothered to turn around and look at Flaherman; neither was he or Jacobs willing to look at the copy of the agenda that Flaherman had. That was the reason I did not speak up; trying to make oneself hear would have been futile.**

The question now becomes: was this a simple mistake on Jacobs’ part, or was this a deliberate effort to deny the public the right to comment?

Both Flaherman and an attorney who spoke during the public comments section, David Soares, tried to persuade Jones on the break. Jones said they needed to speak to the general counsel, Jacobs. Flaherman brought up the issue with Jacobs that CalPERS had not taken the steps under California law to have the right to impose a three minute limit on public comments, as it had for years. He argued that if the public was being denied its right to speak after each agenda item, they certainly had the right to speak longer than three minutes when they finally were permitted to speak (more on this in due course).

During this discussion, it became apparent that Jacobs was trying to claim that a printed version of the agenda, that had been presented to the board before the meeting, was what governed how the session would be held. We’ve embedded it at the end of the post. You can see that it differs from the online agenda, which is clearly the Internet notice as stipulated by law. It is difficult to fathom how anyone could credibly argue that a printed piece of paper supercedes the notices of the agenda that one is routed to from this link:

David Soares, the attorney who objected during the public comments section about the lack of disclosure regarding the extensive conflicts of interest of CalPERS’ star witness, Harvard Professor Josh Lerner, said he spoke to Jacobs after the meeting. He showed Jacobs the official agenda published on the Internet on a smartphone. Jacobs tried claiming that it was a matter of opinion as to what the agenda said. Soares apparently had to tell him repeatedly that what was clearly published on CalPERS’ own website as its public agenda was no “opinion” and it was also not the same as the printed version given to the board.

An attorney who reviewed these materials and the exchanges said via e-mail (emphasis his):

The law is crystal clear that the meeting agenda must be posted publicly. The agenda that the Investment Committee members had before them on November 16, 2016 was not the publicly posted meeting agenda. That is an unambiguous violation of California Government Code sections 11125(a) and 11125(b), which require that an agenda be prepared and made public both in writing and on the Internet 10 days before any meeting.

The public agenda appears to invite public comment after each “Agenda Item” while the printed agenda distributed to the Board members on the Investment Committee does not. The only reasonable interpretation of the uncontroverted evidence is that a different printed agenda was distributed to the Investment Committee in order to suppress public comment in violation of the letter and spirit of the Bagley-Keene Open Government Act of 2004.

In addition, the lack of scrambling and any sign of confusion (which is what you’d expect if there had indeed been a mistake) supports a cynical interpretation of the quashing of public comments. And that is consistent with the steasmrollering of Flaherman. Had there had been any willingness to engage with Flaherman in a good faith manner, whether during the session proper or on the lunch break, the fact that the board had been given a different agenda than the official one would have been exposed, and it would be well nigh impossible to defend the position that the printed one governed. Keep in mind that CalPERS also had warning that private equity skeptics were planning on making an appearance; Flaherman and I had both signed up to speak on line, before the day of the meeting.***

There’s no question that the result was shorter and less effective public statements. I had planned to speak four times; the others who were there all intended to speak at least twice. Nneedeless to say, having our remarks come long after the sections of the presentation they were addressing blunted the impact of the remakrs.

Impermissibly Limiting the Amount of Time for Each Speaker

CalPERS has always limited the amount of time for each member of the public to speak after a specific agenda item to three minutes. It turns out it lacks the authority to do so.

I learned after the private equity workshop that Flaherman brought up this issue during the workshop’s lunch break, presumably pressing for each speaker to have more time when they finally would get to speak at the tail end of the workshop.

Bear in mind that Bagley-Keene Act does allow state bodies to impose reasonable limits on remarks by members of the public. From Section 11125.7:

(b) The state body may adopt reasonable regulations to ensure that the intent of subdivision (a) is carried out, including, but not limited to, regulations limiting the total amount of time allocated for public comment on particular issues and for each individual speaker.

However, the statement that a state body “may adopt reasonable regulations” limiting speaker time is clearly a reference to the regulation adoption process stipulated in the California Administrative Procedures Act. This law is very specific about what it takes to “adopt a regulation.” It does not allow is for a state agency to make things up as they go along and declare, “This is our rule and everyone has to abide by it.” Instead, an agency has to comply with a formal proposed rule notice process and hold a public hearing on it. Only then can it adopt it, at which point the regulation is published in the Code of California Regulations (CCR).

Here is the section of the CCR that deals with CalPERS. There appears to be no regulation on public comments at board meetings:

It thus looks like CalPERS never went through the process that would allow it to restrict the length of public comments. Instead, it appears to have imposed limits and assumed no one would ever challenge them.

You see Henry Jones make a faux gracious gesture to try to cover for the fact that he actually has no right to limit the comment period:

Investment Committee Chairman Henry Jones: Normally our practice is to allow three minutes to speak, but I think we have enough time, and we’re gonna extend that to five minutes today if anyone wants to speak, because I know it’s a lot of material, and I don’t know what part you may have an interest in speaking on, but we are going to extend it to five minutes.

Jones cut me off when his alarm went off at five minutes (you can hear the chirp on the recording). That was only partway through my remarks on the Institutional Limited Partners Association, an organization that CalPERS and its experts touted as an organization that would “advance limited partner interests” and thus was the best avenue for CalPERS and other limited partners to use to gain ground with general partners. The board was thus denied the opportunity to hear the most damning bit of evidence, that ILPA is bought and paid for by the general partners. Nearly 80% of its annual expenses come from a single “pay to play” event funded by private equity firms. No wonder ILPA denies having any advocacy role!

It’s not hard to imagine that the board was kept from hearing similarly important information from other members of the public.

And if you listen carefully to Jones, he acknowledged that CalPERS’ time limits have been a mere “practice,” it suggests he knew full well he was exceeding his authority when he shut me off and succeeded in having other speakers curtail their remarks to conform to the five-minute limit.

A member of the audience who had sat right behind Jones, spoke to me after the board meeting. He’d heard the discussion with Jones over the public comment time limits.

That audience member saw the general counsel, Jacobs, hand a piece of yellow paper to Jones after the lunch break. He could read nearly all of it. It clearly said “not authorized” regarding the time limits. The audience member is 99% certain from what they saw that Jacobs informed Jones that he could not impose time limits on public comments. That would seem logical given CalPERS’ evident failure to go through the steps required for them to do that. Nevertheless, Jones proceeded with his illegal remedy of a five minute limit instead.

This evidence should be deeply disturbing to every California taxpayer. If CalPERS is willing to break rules so casually to avoid tame challenges to its thinking, and one that any public institution should accept as part of its role, what is it capable of doing to cover up real dirt?

And what is particularly troubling in light of this casual attitude about breaking the law is that CalPERS now has a board that is unwilling, and may be so enfeebled as to be unable, to do adequate oversight. As North Carolina’s former chief investment officer, Andrew Silton, wrote:

When pension plans, or for that matter any organization, face big challenges its board needs to be very active. At CalPERS, we have a lot of video evidence that only one trustee is asking probing questions and that the staff and governance committee would like to limit his inquiries. In my view, all of the trustees should be asking tough and probing questions. The board and committee meetings should be interactive and at times even raucous. After all they’re facing tough problems. Moreover, the trustees should have an independent and unbiased fiduciary counsel who exclusively advises them on their role as fiduciaries.

I doubt CalPERS will change because they’ve lost their way.

It may be even worse than Silton suggests. CalPERS seems determined to double down on its dubious choices when questioned. While that course of action may achieve an illusion of smoother sailing short term, it will produce an even larger shipwreck in the end. One can only hope that the damage will be limited to CalPERS’ staff and board, and spares beneficiaries and California taxpayers.

____

* Robert Rubin, who lives in the building next door to mine, for year, and during the time when he spoke at the conference at which I was part of the warm-up act, would regularly have bodyguards in tow in NYC.

** CalPERS made shockingly heavy-handed use of its guards, which searched people not only coming into the CalPERS building but every time when they went into the smaller meeting room. I’ve been regularly on panels Washington DC at events where current government officials were speaking, as well as people who consider themselves important enough to have their own bodyguards,* and I’ve similarly been in small group meetings in the Treasury, twice, with Geither and the other senior members of the Treasury. A second round of screening (a second bag examination and being swiped with a metal detector each time you entered the room) is unheard of.

When Flaherman went to continue his objections to Jones on the break, and Flaherman was polite and did not raise his voice, I saw the guards started crowding him after the first couple of minutes. When I discussed this incident later, a former official was appalled: “When I was in office, if a member of the public wanted to tell you something, you had to stand there and take it. That was part of your job.”

*** There were further signs of bad faith later on, in that several of the people who had signed up to speak on line (members of the public who want to speak have to sign up, either in advance on the Internet or at the time of the meeting) were not called to speak at the public comments time. They had to rush up to sign forms, which distracted attention from the member of the public who was speaking at that time. This sort of sign up is bog standard routine at CalPERS; it’s a fixture of each and every board meeting. The notion that it would conveniently go kerfulie all on its own when so many well-known skeptics planned to speak is quite a stretch.

CalPERS printed PE workshop agenda

Source Article from http://feedproxy.google.com/~r/blacklistednews/hKxa/~3/6XgO87tNyxQ/M.html

Related posts:

Views: 0

RSS Feed

RSS Feed

December 8th, 2015

December 8th, 2015  Awake Goy

Awake Goy  Posted in

Posted in  Tags:

Tags: