Housing’s Echo Bubble Now Exceeds the 2006-07 Bubble Peak

By Charles Hugh Smith

washingtonsblog.com

A funny thing often occurs after a mania-fueled asset bubble pops: an echo-bubble inflates a few years later, as monetary authorities and all the institutions that depend on rising asset valuations go all-in to reflate the crushed asset class.

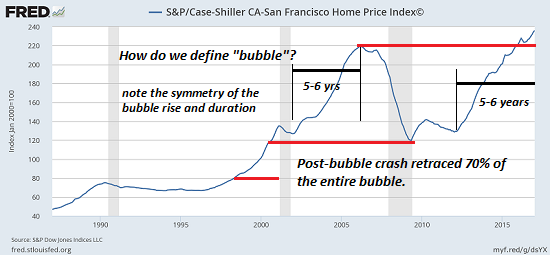

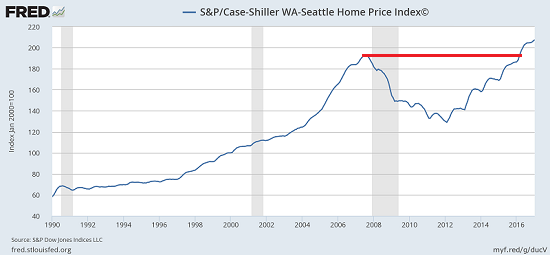

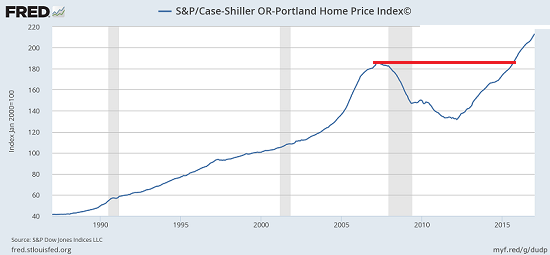

Take a quick look at the Case-Shiller Home Price Index charts for San Francisco, Seattle and Portland, OR. Each now exceeds its previous Housing Bubble #1 peak:

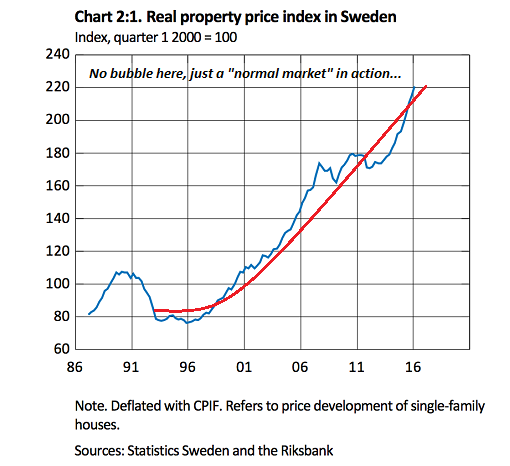

Is an asset bubble merely in the eye of the beholder? This is what the multitudes of monetary authorities (central banks, realty industry analysts, etc.) are claiming: there’s no bubble here, just a “normal market” in action.

This self-serving justification–a bubble isn’t a bubble because we need soaring asset prices–ignores the tell-tale characteristics of bubbles. Even a cursory glance at these charts reveals various characteristics of bubbles: a steep, sustained lift-off, a defined peak, a sharp decline that retraces much or all of the bubble’s rise, and a symmetrical duration of the time needed to inflate and deflate the bubble extremes.

It seems housing bubbles take about 5 to 6 years to reach their bubble peaks, and about half that time to retrace much or all of the gains.

Bubbles have a habit of overshooting on the downside when they finally burst. The Federal Reserve acted quickly in 2009-10 to re-inflate the housing bubble by lowering interest rates to near-zero and buying over $1 trillion of mortgage-backed securities.

When bubbles are followed by echo-bubbles, the bursting of the second bubble tends to signal the end of the speculative cycle in that asset class. There is no fundamental reason why housing could not round-trip to levels below the 2011 post-bubble #1 trough.

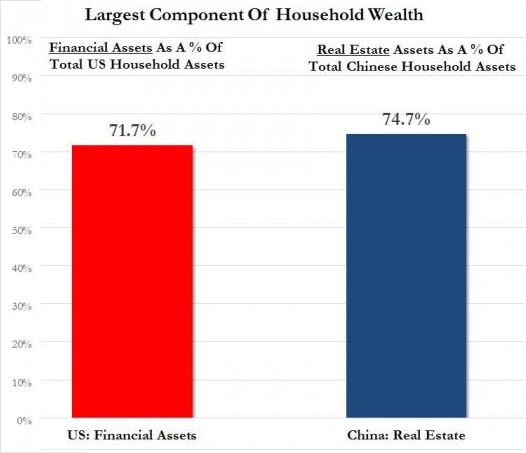

Consider the fundamentals of China’s remarkable housing bubble. The consensus view is: sure, China’s housing prices could fall modestly, but since Chinese households buy homes with cash or large down payments, this decline won’t trigger a banking crisis like America’s housing bubble did in 2008.

The problem isn’t a banking crisis; it’s a loss of household wealth, the reversal of the wealth effect and the decimation of local government budgets and the construction sector.

China is uniquely dependent on housing and real estate development. This makes it uniquely vulnerable to any slowdown in construction and sales of new housing.

About 15% of China’s GDP is housing-related. This is extraordinarily high. In the 2003-08 housing bubble, housing’s share of U.S. GDP barely cracked 5%.

Of even greater concern, local governments in China depend on land development sales for roughly 2/3 of their revenues. (These are not fee simple sales of land, but the sale of leasehold rights, as all land in China is owned by the state.)

There is no substitute source of revenue waiting in the wings should land sales and housing development grind to a halt. Local governments will lose a majority of their operating revenues, and there is no other source they can tap to replace this lost revenue.

Since China authorized private ownership of housing in the late 1990s, homeowners in China have only experienced rising prices and thus rising household wealth. The end of that “rising tide raises all ships” gravy train will dramatically alter China’s household wealth and local government income.

If you need some evidence that the echo-bubble in housing is global, take a look at this chart of Sweden’s housing bubble. Oops, did I say bubble? I meant “normal market in action.”

Who is prepared for the inevitable bursting of the echo bubble in housing?Certainly not those who cling to the fantasy that there is no bubble in housing.

NOTE: James Collins, please email me re: your generous contribution via Dwolla.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

View the original article at Washingtons Blog

Source Article from http://feedproxy.google.com/~r/DarkPolitricks/~3/EXDJNHnYXMk/

Related posts:

Views: 0

RSS Feed

RSS Feed

April 26th, 2017

April 26th, 2017  Awake Goy

Awake Goy  Posted in

Posted in  Tags:

Tags: