Global Financial Meltdown: Sweeping Deregulation of the US Banking System

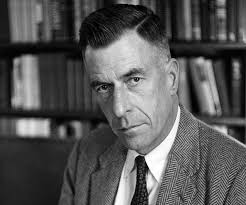

By Prof Michel Chossudovsky

Global Research, March 17, 2023

Author’s Introduction

The 1999 financial sector reforms had set the stage for the 2007-2009 as well as the current 2020-2023 financial crisis.

While the 1999 US Financial Services Act does not in itself break down remaining barriers to the free movement of capital, in practice, it empowers Wall Street’s key players to develop a hegemonic position in global banking, overshadowing and ultimately destabilizing financial systems in Asia, Latin America and Eastern Europe…

“The “global financial supermarket” is to be overseen by the Wall Street giants; competing banking institutions are to be removed from the financial landscape. State level banks across America will be displaced or bought up, leading to a deadly string of bank failures. In turn, the supervisory powers of the Federal Reserve Board (which are increasingly under the direct dominion of Wall Street) have been significantly weakened. (quoted from my text below)

Free from government regulation, the financial giants have the ability to strangle local-level businesses in the US and overshadow the real economy.

The 1999 legislation had repealed the Glass-Steagall Act of 1933, a pillar of President Roosevelt’s “New Deal” which was put in place in response to the climate of corruption, financial manipulation and “insider trading” which led to more than 5,000 bank failures in the years following the 1929 Wall Street crash.

Effective control over the entire US financial services industry (including insurance companies, pension funds, securities companies, etc.) had been transferred to a handful of financial conglomerates – which are also the creditors and shareholders of high tech companies, the defense industry, major oil and mining consortia, etc.

Moreover, as underwriters of the public debt at federal, state and municipal levels, the financial giants have also reinforced their stranglehold on politicians, as well as their command over the conduct of public policy.

Rather than taming financial markets in the wake of the storm, Washington was busy pushing through the US Senate legislation, which was to significantly increase the powers of the financial services giants and their associated hedge funds.

Under the Financial Modernization Act adopted in November 1999, US lawmakers had set the stage for a sweeping deregulation of the US banking system.

In the wake of lengthy negotiations, all regulatory restraints on Wall Street’s powerful banking conglomerates were revoked “with a stroke of the pen”. Under the new rules – ratified by the US Senate and approved by President Clinton – commercial banks, brokerage firms, hedge funds, institutional investors, pension funds and insurance companies can freely invest in each others businesses as well as fully integrate their financial operations.

The “global financial supermarket” is to be overseen by the Wall Street giants; competing banking institutions are to be removed from the financial landscape. State level banks across America will be displaced or bought up, leading to a deadly string of bank failures. In turn, the supervisory powers of the Federal Reserve Board (which are increasingly under the direct dominion of Wall Street) have been significantly weakened.”

The following text reviews, in a historical context, the 1987, 1997 and 1998 stock market meltdowns.

The article was written 23 years ago in November 1999, following the adoption of the 1999 Financial Services Modernization Act.

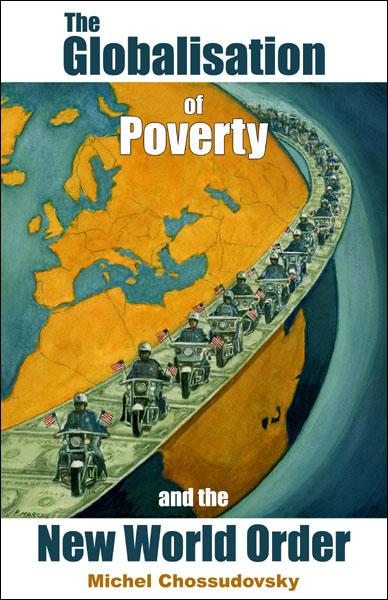

It was subsequently published as a chapter in the Second Edition of The Globalization of Poverty and the New World Order, Global Research, Montreal, 2003.

The adoption of the Financial Services Modernization Act in 1999 is crucial to our understanding of the ongoing 2020-2023 financial crisis.

Michel Chossudovsky, March 16, 2023

Global Financial Meltdown:

Sweeping Deregulation of the US Banking System

by Michel Chossudovsky

November 1999

Introduction

A new global financial environment has unfolded in several stages since the collapse of the Bretton Woods system of fixed exchange rates in 1971. The debt crisis of the early 1980s (broadly coinciding with the Reagan-Thatcher era) had unleashed a wave of corporate mergers, buy-outs and bankruptcies. These changes have, in turn, paved the way for the consolidation of a new generation of financiers clustered around the merchant banks, the institutional investors, stock brokerage firms, large insurance companies, etc. In this process, commercial banking functions have coalesced with those of the investment banks and stock brokers.1

While these “money managers” play a powerful role on financial markets, they are, however, increasingly removed from entrepreneurial functions in the real economy. Their activities (which often escape state regulation) include speculative transactions in commodity futures and derivatives, and the manipulation of currency markets. Major financial actors are routinely involved in “hot money deposits” in “the emerging markets” of Latin America and Southeast Asia, not to mention money laundering and the development of (specialized) “private banks” (“which advise wealthy clients”) in the many offshore banking havens. Within this global financial web, money transits at high speed from one banking haven to the next in the intangible form of electronic transfers. “Legal” and “illegal” business activities have become increasingly intertwined, vast amounts of unreported private wealth have been accumulated. Favoured by financial deregulation, the criminal mafias have also expanded their role in the spheres of international banking.2

The 1987 Wall Street Crash

Black Monday October 19, 1987 was the largest one-day drop in the history of the New York Stock Exchange overshooting the collapse of October 28, 1929, which prompted the Wall Street crash and the beginning of the Great Depression.

In the 1987 meltdown, 22.6 percent of the value of US stocks was wiped out largely during the first hour of trading on Monday morning. The plunge on Wall Street sent a cold shiver through the entire financial system leading to the tumble of the European and Asian stock markets…

The Institutional Speculator

The 1987 Wall Street crash served to “clearing the decks” so that only the “fittest” survive. In the wake of crisis, a massive concentration of financial power has taken place. From these transformations, the “institutional speculator” emerged as a powerful actor overshadowing and often undermining bona fide business interests. Using a variety of instruments, these institutional actors appropriate wealth from the real economy. They often dictate the fate of companies listed on the New York Stock Exchange. Totally removed from entrepreneurial functions in the real economy, they have the power of precipitating large industrial corporations into bankruptcy.

In 1993, a report of Germany’s Bundesbank had already warned that trade in derivatives could potentially “trigger chain reactions and endanger the financial system as a whole”.3 While committed to financial deregulation, the Chairman of the US Federal Reserve Board Mr. Alan Greenspan had warned that: “Legislation is not enough to prevent a repeat of the Barings crisis in a high tech World where transactions are carried out at the push of the button”.4 According to Greenspan “the efficiency of global financial markets, has the capability of transmitting mistakes at a far faster pace throughout the financial system in ways which were unknown a generation ago…”5 What was not revealed to public opinion was that “these mistakes”, resulting from large-scale speculative transactions, were the source of unprecedented accumulation of private wealth.

By 1995, the daily turnover of foreign exchange transactions (US$ 1300 billion) had exceeded the world’s official foreign exchange reserves estimated at US$ 1202 billion.6 The command over privately-held foreign exchange reserves in the hands of “institutional speculators” far exceeds the limited capabilities of central banks, – i.e. the latter acting individually or collectively are unable to fight the tide speculative activity.

The 1997 Financial Meltdown

The 1987 crisis had occurred in October. Almost to the day, ten years later (also in October) on Monday the 27th, 1997, stock markets around the world plummeted in turbulent trading. The Dow Jones average nose-dived by 554 points, a 7.2 percent decline of its value, its 12th-worst one-day fall in the history of the New York Stock Exchange.

Major exchanges around the world are interconnected “around the clock” through instant computer link-up: volatile trading on Wall Street “spilled over” into the European and Asian stock markets thereby rapidly permeating the entire financial system. European stock markets were in disarray with heavy losses recorded on the Frankfurt, Paris and London exchanges. The Hong Kong stock exchange had crashed by 10.41 percent on the previous Thursday (“Black Thursday” October 24th) as mutual fund managers and pension funds swiftly dumped large amounts of Hong Kong blue chip stocks. The slide at Hong Kong’s Exchange Square continued unabated at the opening of trade on Monday morning: a 6.7 percent drop on Monday the 27th followed by a 13.7 percent fall on Tuesday (Hong Kong’s biggest point loss ever)…

[ltr]Who are the Architects of Economic Collapse?[/ltr]

Table 1

New York Stock Exchange: Worst Single-Day Declines (Dow Jones Industrial Average, percentage change)

Percentage Date Decline [1929-1998]

October 19, 1987 – 22.6%

October 28, 1929 – 12.8%

October 29, 1929 – 11.7%

November 6, 1929 – 9.9%

August 12, 1932 – 8.4%

October 26, 1987 – 8.0%

July 21, 1933 – 7.8%

October 18, 1937 – 7.6%

October 27, 1997 – 7.2%

October 5, 1932 – 7.2%

September 24, 1931 – 7.1%

August 31, 1998 – 6.4%

Source: New York Stock Exchange

The 1997 meltdown of financial markets had been heightened by computerized trading and the absence of state regulation. The NYSE’s Superdot electronic order-routing system was able to handle (without queuing) more than 300,000 orders per day (an average of 375 orders per second), representing a daily capacity of more than two billion shares. While its speed and volume had increased tenfold since 1987, the risks of financial instability were significantly greater.

Ten years earlier, in the wake of the 1987 meltdown, the US Treasury was advised by Wall Street not to meddle in financial markets. Free of government encroachment, the New York and Chicago exchanges were invited to establish their own regulatory procedures. The latter largely consisted in freezing computerized programme trading through the use of so-called “circuit-breakers”.7

In 1997, the circuit breakers proved to be totally ineffective in averting a meltdown. On Monday the 27th of October 1997, a first circuit breaker halted trading for 30 minutes after a 350 point plunge of the Dow Jones. After the 30 minute trading halt, an aura of panic and confusion was installed: brokers started dumping large quantities of stocks which contributed to accelerating the collapse in market values. In the course of the next 25 minutes, the Dow plunged by a further 200 points, triggering a second “circuit breaker” which served to end the trading day on Wall Street.

Replicating the Policy Failures of the late 1920s

“Wall Street was swerving dangerously in volatile trading in the months preceding the Wall Street crash on October 29, 1929. Laissez-faire, under the Coolidge and Hoover administrations, was the order of the day. The

possibility of a financial meltdown had never been seriously contemplated. Professor Irving Fisher of Yale University had stated authoritatively in 1928 that “nothing resembling a crash can occur”. The illusion of economic prosperity persisted seeral years after the Wall Street crash of October 1929.

In 1930, Irving Fisher stated confidently that “for the immediate future, at least, the perspective is brilliant”. According to the prestigious Harvard Economic Society: “manufacturing activity [in 1930]… was definitely on the road to recovery” (quoted in John Kenneth Galbraith, The Great Crash, 1929, Penguin, London).

Mainstream Economics Upholds Financial Deregulation

Sounds familiar? In the wake of the 1997 crash, the same complacency prevailed as during the frenzy of the late 1920s. Echoing almost verbatim the economic slogans of Irving Fisher, today’s economics orthodoxy not only refutes the existence of an economic crisis, it denies outright the possibility of a financial meltdown. According to Nobel Laureate Robert Lucas of the University of Chicago, the decisions of economic agents are based on so-called “rational expectations”, ruling out the possibility of “systematic errors” which might lead the stock market in the wrong direction… It is ironic that precisely at a time when financial markets were in turmoil, the Royal Swedish Academy announced the granting of the 1997 Nobel Prize in Economics to two American economists for their “pioneering formula for the valuation of stock options [and derivatives] used by thousands of traders and investors” (meaning an “algebraic formula” which is routinely used by hedge funds stock market speculators). (See Greg Burns, “Two Americans Share Nobel in Economics”, Chicago Tribune, October 15, 1997).

The 1997 Asian Crisis

When viewed historically, the 1997 financial crisis was far more devastating and destructive than previous financial meltdowns. Both the stock market and currency markets were affected. In the 1987 crisis, national currencies remained relatively stable. In contrast to both the crashes of 1929 and 1987, the 1997-98 financial crisis was marked by the concurrent collapse of currencies and stock markets. An almost symbiotic relationship between the stock exchange and the foreign currency market had unfolded: “institutional speculators” were not only involved in manipulating stock prices, they also had the ability to plunder central banks’ foreign exchange reserves, undermining sovereign governments and destabilizing entire national economies.

In the course of 1997, currency speculation in Thailand, Indonesia, Malaysia and the Philippines was conducive to the transfer of billions of dollars of central bank reserves into private financial hands. Several observers have pointed to the deliberate manipulation of equity and currency markets by investment banks and brokerage firms.8 Ironically, the same Western financial institutions which looted developing countries’ central banks, have also offered “to come to the rescue” of Southeast Asia’s monetary authorities. ING Baring, for instance, well known for its speculative undertakings, generously offered to underwrite a one-billion dollar loan to the Central Bank of the Philippines (CBP) in July 1997. In the months which followed, most of these borrowed foreign currency reserves were reappropriated by international speculators when the CBP sold large amounts of dollars on the forward market in a desperate attempt to prop up the Peso.

“Economic Contagion”

Business forecasters and academic economists alike had disregarded the dangers of a global financial meltdown alluding to “strong economic fundamentals”; G7 leaders were afraid to say anything or act in a way, which might give the “wrong signals”… Wall Street analysts continue to bungle on issues of “market correction” with little understanding of the broader economic picture.

The plunge on the New York Stock Exchange on October 27th 1997 was casually blamed on the “structurally weak economies” of Southeast Asia, until recently heralded as upcoming tigers, now depicted as “lame ducks”. The seriousness of the financial crisis was trivialized: Alan Greenspan, Chairman of the Federal Reserve Board, reassured Wall Street pointing authoritatively to “the contagious character of national economies, spreading weaknesses from country to country”. Following Greenspan’s verdict (October 28th), the “consensus” among Manhattan brokers and US academics (with debate or analysis) was that “Wall Street had caught the Hong Kong flu”…

The 1998 Stock Market Meltdown

In the uncertain wake of Wall Street’s recovery from the 1997 “Asian flu” – largely spurred by panic flight out of Japanese stocks – financial markets backslided a few months later to reach a new dramatic turning-point in August 1998 with the spectacular nose-dive of the Russian ruble. The Dow Jones plunged by 554 points on August 31, 1998 (its second largest decline in the history of the New York stock exchange) leading, in the course of September, to the dramatic meltdown of stock markets around the World. In a matter of a few weeks, 2300 billion dollars of “paper profits” had evaporated from the U.S. stock market.

The ruble’s August 1998 free-fall had spurred Moscow’s largest commercial banks into bankruptcy leading to the potential take-over of Russia’s financial system by a handful of Western banks and brokerage houses. In turn, the crisis had created the danger of massive debt default to Moscow’s Western creditors, including the Deutsche and Dresdner banks. Since the outset of Russia’s macro-economic reforms, following the first injection of IMF “shock therapy” in 1992, some 500 billion dollars worth of Russian assets – including plants of the military industrial complex, infrastructure and natural resources – have been confiscated (through the privatization programs and forced bankruptcies) and transferred into the hands of Western capitalists. In the brutal aftermath of the Cold War, an entire economic and social system was being dismantled

Financial Deregulation

Rather than taming financial markets in the wake of the storm, Washington was busy pushing through the US Senate legislation, which was to significantly increase the powers of the financial services giants and their associated hedge funds. Under the Financial Modernization Act adopted in November 1999 – barely a week before the historic Seattle Millenium Summit of the World Trade Organization (WTO) – US lawmakers had set the stage for a sweeping deregulation of the US banking system.

In the wake of lengthy negotiations, all regulatory restraints on Wall Street’s powerful banking conglomerates were revoked “with a stroke of the pen”. Under the new rules – ratified by the US Senate and approved by President Clinton – commercial banks, brokerage firms, hedge funds, institutional investors, pension funds and insurance companies can freely invest in each others businesses as well as fully integrate their financial operations.

The legislation had repealed the Glass-Steagall Act of 1933, a pillar of President Roosevelt’s “New Deal” which was put in place in response to the climate of corruption, financial manipulation and “insider trading” which led to more than 5,000 bank failures in the years following the 1929 Wall Street crash.9 Effective control over the entire US financial services industry (including insurance companies, pension funds, securities companies, etc.) had been transferred to a handful of financial conglomerates – which are also the creditors and shareholders of high tech companies, the defense industry, major oil and mining consortia, etc. Moreover, as underwriters of the public debt at federal, state and municipal levels, the financial giants have also reinforced their stranglehold on politicians, as well as their command over the conduct of public policy.

The “global financial supermarket” is to be overseen by the Wall Street giants; competing banking institutions are to be removed from the financial landscape. State level banks across America will be displaced or bought up, leading to a deadly string of bank failures. In turn, the supervisory powers of the Federal Reserve Board (which are increasingly under the direct dominion of Wall Street) have been significantly weakened .

Free from government regulation, the financial giants have the ability to strangle local-level businesses in the US and overshadow the real economy. In fact, due to the lack of competition, the legislation also entitles the financial services giants (bypassing the Federal Reserve Board and acting in tacit collusion with one another) to set interest rates as they please.

The Merger Frenzy

A new era of intense financial rivalry has unfolded. The New World Order – largely under the dominion of American finance capital – was eventually intent on dwarfing rival banking conglomerates in Western Europe and Japan, as well as sealing strategic alliances with a “select club” of German- and British-based banking giants.

Several mammoth bank mergers (including NationsBank with BankAmerica, and Citibank with Travelers Group) had, in fact, already been implemented and rubber-stamped by the Federal Reserve Board (in violation of the pre-existing legislation) prior to the adoption of the 1999 Financial Modernization Act. Citibank, the largest Wall Street bank, and Travelers Group Inc., the financial services and insurance conglomerate (which also owns Solomon Smith Barney a major brokerage firm) combined their operations in 1998 in a 72 billion dollar merger.10

Strategic mergers between American and European banks had also been negotiated bringing into the heart of the US financial landscape some of Europe’s key financial players including Deutsche Bank AG (linked up with Banker’s Trust) and Credit Suisse (linked up with First Boston). The Hong Kong Shanghai Banking Corporation (HSBC), the UK based banking conglomerate – which had already sealed a partnership with Wells Fargo and Wachovia Corporation – had acquired the late Edmond Safra’s Republic New York Bank in a 9 billion dollar deal.11

In the meantime, rival European banks excluded from Wall Street’s inner circle, were scrambling to compete in an increasingly “unfriendly” global financial environment. Banque Nationale de Paris (BNP) had acquired Société Générale de Banque and Paribas to form one of the World’s largest banks. BNP eventually aspires “to move into North America in a bigger way”.12

Financial Deregulation at a Global Level

While the 1999 US Financial Services Act does not in itself break down remaining barriers to the free movement of capital, in practice, it empowers Wall Street’s key players, including Merrill Lynch, Citigroup, J.P. Morgan, Lehman Brothers, etc., to develop a hegemonic position in global banking, overshadowing and ultimately destabilizing financial systems in Asia, Latin America and Eastern Europe…

Financial deregulation in the US has created an environment which favors an unprecedented concentration of global financial power. In turn, it has set the pace of global financial and trade reform under the auspices of the IMF and the World Trade Organization (WTO). The provisions of both the WTO General Agreement on Trade in Services (GATS) and of the Financial Services Agreement (FTA) imply the breaking down of remaining impediments to the movement of finance capital meaning that Merrill Lynch, Citigroup or Deutsche-Bankers Trust can go wherever they please, triggering the bankruptcy of national banks and financial institutions.

In practice, this process has already happened in a large number of developing countries under bankruptcy and privatization programs imposed on an hoc basis by the Bretton Woods institutions. The mega-banks have penetrated the financial landscape of developing countries, taking control of banking institutions and financial services. In this process, the financial giants have been granted de facto “national treatment”: without recourse to the provisions of the Financial Services Agreement (FTA) of the WTO, Wall Streets banks, for instance, in Korea, Pakistan, Argentina or Brazil have become bona fide “national banks” operating as domestic institutions and governed by domestic laws which are being remolded under IMF-World Bank jurisdiction. (See Chapters 21 and 22.)

In practice the large US and European financial services giants do not require the formal adoption of the GATS to be able to dominate banking institutions worldwide, as well as overshadow national governments. The process of global financial deregulation is, in many regards, a fait accompli. Wall Street has routinely invaded country after country. The domestic banking system has been put on the auction block and reorganized under the surveillance of external creditors. National financial institutions are routinely destabilized and driven out of business; mass unemployment and poverty are the invariable results.

Assisted by the IMF – which routinely obliges countries to open up their domestic banking sector to foreign investment – retail banking, stock brokerage firms and insurance companies are taken over by foreign capital and reorganized. Citigroup, among other Wall Street majors, has gone on a global shopping spree buying up banks and financial institutions at bargain prices in Asia, Latin America and Eastern Europe. In one fell swoop, Citigroup acquired the 106 branch network of Banco Mayo Cooperativo Ltda., becoming Argentina’s second largest bank.

*

Note to readers: Please click the share buttons above. Follow us on Instagram and Twitter and subscribe to our Telegram Channel. Feel free to repost and share widely Global Research articles.

The above text is contained in Chapter 20 of Michel Chossudovsky’s book: The Globalization of Poverty and the New World Order.

Michel Chossudovsky is Professor Emeritus of Economics at the University of Ottawa and Director of the Centre for Research on Globalization (CRG), which hosts the critically acclaimed website www.globalresearch.ca. He is a contributor to the Encyclopedia Britannica. His writings have been translated into more than 20 languages.

MORE HERE: https://www.globalresearch.ca/global-financial-meltdown-sweeping-deregulation-of-the-us-banking-system/10588

Related posts:

Views: 0

RSS Feed

RSS Feed

March 18th, 2023

March 18th, 2023  Awake Goy

Awake Goy

Posted in

Posted in  Tags:

Tags: