Tom Luongo

Gold Goats ‘n Guns

For more than a year I’ve been arguing that the Fed was tightening US dollar supply. When I first put the idea out there it was met with intense skepticism and, for the most part, it still is.

The Fed has long been the punching bag of hard money and alternative finance types because, frankly, it always deserved it. For nearly the past generation, until June of 2021, the Fed acted as the Central Bank of the World.

But we’re rapidly reaching the moment where a lot of people are finally beginning to realize maybe the vaunted “Fed Put,” the belief that the Fed always comes to the market’s rescue isn’t going to show up anytime soon, if at all.

Whenever there was a major crisis on the horizon the Fed was always there to provide the world with the dollars needed to keep things from collapsing completely. This was especially true in the aftermath of Lehman Bros. and the 2008 housing crisis which broke the post-Bretton Woods Dollar Reserve Standard ushered in by Paul Volcker’s extreme monetary policy of the early 1980’s.

2008’s crisis led to the aftershocks of the summer of 2011 when the US lost its AAA debt rating and gold spiked to over$1900 per ounce on the fears the unfolding sovereign debt crisis in Europe would take center stage.

Only a statement of coordinated Central Bank policy from the major players — The Fed, ECB, BoJ, SNB and BoE — stopped the system from melting down then. Under both Ben Bernanke and then Janet Yellen the Fed under President Obama proved time and again unwilling to let asset prices fall lest it take the banking system down.

To effect this these Central Banks took turns expanding their balance sheets through QE until Yellen’s term ended in late 2017 and Jerome Powell took over as Fed chair. The looming demographic crisis in US entitlements forced Yellen to begin the tightening cycle which Powell accelerated.

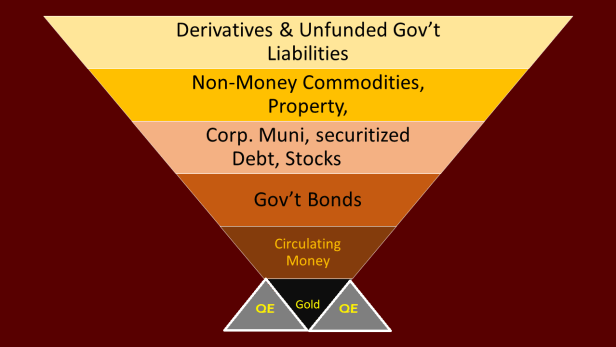

Zero-bound rates fueled stock repurchase programs and a massive boom in equities worldwide. And with it the top layers of Exter’s Pyramid expanded while the base was shored up not with an expansion of gold prices or reserves but with base money, M0.

We can’t call QE ‘circulating money’ because most, if not all of it, was sterilized as bank reserves. So, it has to go to the bottom of the pyramid even if it was mostly just Gov’t debt. Visualizing this as an expansion of the gov’t debt layer is the wrong metaphor, because this was a pyramid trying to tip over, so it’s better to think of the Coordinated Central Bank era as a trying to shore up a leaning tower of debt with more debt rather than fueling new productive business up the value chain based on an expanded pool of savings (gold reserves).

Moreover, in order to keep the gold price from calling the Central Banks’ collective bluff with this scheme we accepted the fiction of producing ‘paper gold’ with this QE rather than adding physical gold to reserves. This is why we’ve seen the ratio of paper gold to exchange reserves explode.

It was in nearly everyone’s best interest to just keep using gold as a currency hedge rather than as a reserve asset. As long as no one wanted the actual gold the leverage could expand and the pyramid would stay more or less upright.

That policy clearly has a limit because in at some point someone will call the bluff about the value of the debt created by QE and ask how can we procure goods while all of our spare activity is being used to service the debt.

Where is the actual growth going to come from?

Growth? How are we even going to stay even?

This is the trap of QE and it meant that at some point there would be a reckoning because you can’t heat your home or feed your kids with digital euros or dollars.

That reckoning had to come in the form of one of the major central banks breaking with the cartel of them. This has been my thesis for more than a year.

And only the Fed had the real incentive to break with the cartelization of the Central Banks because it was the one who was bearing the brunt of the loss of confidence.

For years we heard about how Mario Draghi was the wizard of Europe. The euro remained way too strong. Germany’s mercantilism was still fueled by its insane leverage of cheap Russian gas.

The SNB used this period to become the world’s largest equity hedge fund.

The Bank of Japan was allowed to turn the yen into the ultimate carry currency with its insane yield curve control, which continues to this day.

And the Bank of England was allowed to perpetuate the myth that the pound was a currency backed by anything other than City of London’s financial services and clearinghouse business.

But the Fed’s credibility vanished by degrees every time Europe caught a cold and the Fed showed up with the monetary chicken soup. Now the Fed is facing the same crisis of confidence Volcker faced when he took over for Arthur Burns.

But we have two generations of market participants who have never had to face that. Their imprinting is the Fed always has their back. I’ve warned in the past about this idea that we have guys approaching retirement who have never had to trade a true US treasury bear market.

So, do you really think we’ve reached that point where a majority of people are convinced that the “Fed Put” under the markets is a thing of the past? I don’t.

I look at the complacency of credit spreads and shake my head. Have people really not grokked that the EU is ready to commit their people to deindustrialization, famine and militarization in a Quixotic campaign to rid the world of Russian energy?

Do you really think the Fed is going to bail these people out this time? Why would they? No matter whether you view the US as predatorily destroying Europe or defending itself from Neo-feudal Eurocentric globalists the outcome is the same.

As the guy on Seinfeld used to say, “No Eurodollars for you!”

Just because Fed chairmen have always pivoted at the first sign of trouble in Europe’s troubles in the past doesn’t mean anything. What matters are the threats the Fed is responding to right now. And if you chase those threats down it’s clear what it’s best course of action is.

No pivot. No “Put.” No more Central Bank of the World.

The biggest tail risk in markets today is that complacency; that normie analysis the Fed is just talking tough and doesn’t really mean it.

This is why so many people believed the bullshit after July’s rate hike that the Fed had already pivoted, not because the Fed actually did so but because so many needed to believe that given the positions of their books.

But the incentives are there, especially in the greater geopolitical context, that there is a new world on the horizon which holds a whole lot of positive incentives for American banks and businesses if the Fed holds course here.

This is especially true if Europe continues on the path its on without pivoting on energy policy. Russia has only just begun turning screws on Europe.

The pushback I get from these arguments never addresses this point. What if the US’s future is brighter on the other side of a protracted slowdown and reorganization which prioritizes itself over maintaining the Empire?

Can the Fed hold Congress’ feet to the fire in the absence of foreign central bank buying?

What if the assumption of who runs the Empire is wrong and it’s not actually the US but the same people consolidating power in Europe right now?

The world is de-dollarizing after all. We just watched an SCO Summit in Samarkand go off without a hitch after all the major attendees were beset by fresh new conflicts along Russia’s underbelly.

And yet Putin wasn’t ostracized. Quite the opposite, actually.

To those that think I’m off base, in a multi-polar world where the dollar is diminished but not destroyed is not a global Fed Put not redundant?

I put a lot of this together in a recent Twitter Spaces I did with Michael Gayed filling in some of the history and a quick overview of how we got to today and the US’s path out of its current troubles. Maybe, just maybe it’s the realization that there is a path out that has so many people triggered by these ideas in the first place.

___

https://tomluongo.me/2022/09/18/what-the-end-of-the-fed-put-actually-means/

Related posts:

Views: 0

RSS Feed

RSS Feed

September 19th, 2022

September 19th, 2022  Awake Goy

Awake Goy  Posted in

Posted in  Tags:

Tags: